You can still tap into the pool of 17-odd million Bitcoins that is now in circulation. You can even purchase them in the fiat currency equivalents.

You can still tap into the pool of 17-odd million Bitcoins that is now in circulation. You can even purchase them in the fiat currency equivalents.

But where do you get them then? After all, Cryptocurrency is this dark and mysterious transaction system used only by criminals and drug addicts.

So you acquiring them would naturally be in a shady place like the dark web – where it is used to acquire illicit things – right?

Not quite and there are publicly accessible marketplaces where one can securely purchase Bitcoins.

Find out more via A peer-to-peer Crypto marketplace

Author: Admin

-

A peer-to-peer Crypto marketplace

-

Great PC Phone Plug-ins for your CRM & ERP tools

Before deciding to purchase a top CRM solution like that of Microsoft Dynamics, many companies are left to question the said CRM’s integration capabilities — specifically, whether the Microsoft Dynamics Computer Telephony Integration (CTI) integration is user-friendly.

Find out the benefits, how to do PC (VOIP) phone integrations and what is on offer by a top supplier here: Practical CRM & ERP integration tools

-

Banking made easy!

The sexy looking N26 Metal card is available (for now) in Germany, Austria, France, and Italy!

Read about what this Fintech / savvy online bank is about and has to offer.

via Your portable ATM

-

How would you like to be served?

The thought of “servers” and “hosting” are rarely things you consider on a daily basis. If you are not an IT or a software architect, then probably not at all.

For the mentioned professionals, however, these decisions are critical to the operations of a business however large or small.

There is a fine line between how (and where) your software systems are used. This line has become thinner because of evolving cloud technology and automation.

Sourcing and deploying the right IT architecture could therefore help your business stay afloat, or sink without.Communication is key

The most effective mode of communication in any business (other than verbally or telephonically) is still electronic mail (E-mail).

It is effective because it helps you get a time-stamp and a reference point when it comes to the documentation of your conversations. This is important tool when it comes to your legal obligations and commitments.Emails are, therefore, something that should not be taken for granted!

We consequently send, receive emails with attachments through various devices. All this without a second thought as to how this happens.

After all, this is the job of the IT-guys, right?

Well quite rightly so. They often clash with their management and board of directors for funds to keep this going without compromising operations. Emails are crucial not only from a daily functional point of view but from security but also the compliance facet.Defining servers

Your company’s IT infrastructure: Emails; File-servers; Databases (CRMs and ERPs) and other communication tools are commonly managed on-site on systems referred to as ‘on-premise’ solutions.

These are managed by computer-like CPUs that look like the standard boxes that you plug your monitor and keyboards. They, however, have a lot more processing power and storage than your average desktop and are called Servers.

Your servers naturally must be kept cool because of the heat they generate from being on all the time. As you can imagine, built-in fans are far from being enough to cool them off!

There an array of server types. Each of them is designed to run the tasks of your mail exchanges, file storage, and the storing/deploying of remote PC operating systems. Others handle your databases and other dedicated functions.

You would need to have the licensed software to operate each server providing unique services. This makes it quite an expensive outlay if you have all of the abovementioned requirements!

Servers are not irreplaceable and can overheat, get corrupted, or crash like a hard-drive (or a NAS server system). You, therefore, need to be maintain them at a cost to your business via your IT department.

Depending on the amount of data and complexity, the maintenance is outsourced to specialized IT companies or software license providers.Cloud-computing

In the early 2000s, ‘the cloud’ or ‘cloud computing’ became a new concept. It is basically a very large set of high-end servers equipped with software to manage all the tasks mentioned above. It is usually offered as a service under a single (monthly or annual) subscription.

So basically, you are renting the service of a server as opposed to owning it. Renting, just like with property or cars, relieves the user of all the costs of maintaining the product in question.

This sort of rental service offered by cloud service providers is now known as Software as a Service (SaaS). This also saves you from purchasing any hardware let alone paying for the extra electricity bill to cool a server room.

According to Quora.com, the main difference between a cloud and a datacenter is that a cloud is an ‘off-premise’ form of computing that stores data on the Internet.

A Datacenter, on the other hand, is an on-premise set of hardware that stores data within an organization’s local network.

As an IT professional, you constantly face the burning question of whether to go for a solution that will relieve you of mundane tasks – like server maintenance. Naturally, you would also want a solution that facilitates the daily administering of user-profiles, data archiving, and backups. But to what costs then?Deciding on which to go for

There are many pros and cons when it comes to the hosting of your company’s data on a local server as opposed to having it run via the cloud. There is also a massive array of choices and bundles between the top cloud service providers.

Cloud service providers have several data centers used as backups. So your email hosting may have several servers in different locations to serve that function. This curbs the risk of your data getting lost, unavailable, or hacked.Naturally, Datacenters are kept highly secure in undisclosed locations globally. Google is known to have one of its datacenters floating on a massive container ship somewhere over the Atlantic ocean.

Maintenance

Maintaining a server is expensive as you require massive cooling systems. Some smarter companies like Microsoft, are now taking to the deep oceans for that function.

When it comes to email hosting or the storage of your files in the cloud only five large multinational corporations’ names come to mind. Microsoft, Oracle, Google, IBM, and Amazon.

These companies however bear the burden of maintenance, while providing just the service you require on a subscription basis.

Setting up an on-premise solution, in contrast, can be a tedious exercise and an expensive one. This is more applicable to smaller companies that do not have large IT budgets.Licensing your server is no child’s play either!

Having to decide on costs versus functionality will determine how to license your server. This would be either per-server, per virtual machine needed, or per processor core and then you need CALs). If you don’t believe it, just have a look at this licensing guide!

An example

To illustrate the difference, let’s say you have an outlay of a hundred thousand dollars to acquire the software licenses for three years. This compared to a cloud-hosted package that performs the same function over the same timeframe.

You can then piggy-back off companies like Amazon and Microsoft’s security services, which then costs eight thousand dollars monthly ($96k annually).

So, within three years of using the cloud, you would have reached the $100K cap that would be spent only for licenses. You would have also saved with an extra $188K in additional services.

This is a portion of what you would have been spent on maintenance, technical support, security, upgrades, and updates.

These figures are rudimentary, but the long-term savings are noticeable as cloud service providers tend to provide value-add solutions when pricing their bundles.

Microsoft recently launched its Microsoft 365 package which includes an upgrade to the latest operating system (Windows 10 Professional or Enterprise). This is something you would have had to source and pay for separately.Stress relievers

Software deployment and the administration of user accounts is cloud-based. This means you can do this conveniently and remotely from your PC, laptop, tablet, or even your smartphone!

This means as an IT professional, you will now have more time to oversee more important issues like data security and overall IT policies. Better yet, you would have the time to investigate ways to automate and improve your systems.

This is possible without the inconvenience of running from PC-to-PC to install operating systems, Office software, or manage mailboxes.

Remote desktop services of an on-premise server were a step in this direction – but are a pain to set up. So, you can view the cloud as an evolution of remote-desktop services.Infrastructural setbacks

The only (and potential) hindrance to using cloud services naturally would be the availability of good and cheap broadband (Internet connectivity).

Without both, the justification for running your business fully on the cloud would not stick. Some businesses, especially in developing countries, go endure desperates attempts to adopt the cloud.They use what is known as hybrid-systems: a combination of cloud and on-premise solutions.

If you operate in a country without forward-thinking government officials that facilitate broadband availability, you will suffer the most.

Like an old, car, outdated hardware and software can lead to costly services (out-of-date and warranty solutions). This leads to you having heftier maintenance fees and support costs by third-party IT professionals.

The old rhetoric of ‘not trusting the cloud’ is now one of the past. Cloud services often outperform on-premise solutions when it comes to high-end security software and data protection. This is because of the obvious economies of scale involved in setting up expensive security software.

The level of security has to be the digital equivalent of Fort Knox. This especially if you are dealing with sensitive data such as financial, legal services, healthcare, and educational institutions.

Your company would need a system that will keep all such data secure and data compliant.

Data is now treated as a commodity. There is now a subsequent need to trade and value it. We now have Blockchain-based solutions like IOTA to facilitate your payments. This while keeping data encrypted, decentralized, and safe.In the advent of the new GDPR laws, some companies will still opt to keep and maintain their servers internally. By doing this, however, you might lack the transparency and tools needed to show your consumers how you handle their sensitve data.

-

Top Crypto coins to look out for now

Some nice insights into the trending top Cryptocurrency coins out there with a good explanation as to why they are great coins to invest in.

A good idea to look into these ahead of a potential June ‘bull run’ via My TOP 10 Coins

Or you can own Bitcoins directly:

-

Criminal mindedness

One fundamental and often ignored view within economics is that humans have the propensity to display irrational behaviour in the decision-making processes.

Based on this notion, one can conclude that we have a fundamental tendency to act corruptly and be generally criminally-inclined except maybe the virtuous few.

How advanced our economy or society is, depends on what measures or incentives we enforce to deter or punish criminals.

In most cases, we find that in countries where punishment is severe (e.g. in Central Europe or Nigeria), the criminals end up moving to less strict countries.

The economics of crime, especially violent crime experienced in countries like South Africa and Brazil, is something that requires adept research if anything is to be done.

In the US, studies were conducted to access the impact of legalized abortion on the level of crime. This was discussed in detail in a best-selling book by Levitt and Dubner’s called Freakonomics.

The study found that legalizing abortion (seen by many as legalized killing equivalent to death sentences) reduces the level of drug abuse and subsequently other criminal activity.The real problem

Perhaps there is no relevance here but for instance, abortion is legal in South Africa yet a high crime rate prevails. So, what’s the problem then?

Part of the problem lies in the fact that the incentives/benefits of committing crime far outweigh the “costs” and chances of being caught and convicted by the judiciary.

John Nash through his renowned works (well at least amongst economists), devised what he called “game theory” or “the prisoner’s dilemma”.

Cheating occurs through degrees of severity from a classroom test or examination all the way to the plotting and execution of murder or indirectly killing individuals by selling users addictive drugs.

Then you have your white-collar crime such as insider trading, corporate espionage (unlawfully acquiring recipes, formulas, and technologies from rival companies).

Or simply ‘cooking the books’ or siphoning off profits from a company’s coffers.

Nash’s rationale for such cheating behaviour boils down to the attitude of: ‘if I don’t, someone else will, and leave me with the short end of the stick – so given the option, I’ll always cheat’.

His explanation is one ‘formally proven’ reason for human ‘irrational’ behaviour – or rather, could we say it is rational if the outcome is to favour the decision-maker in the short or long term? This is instinct is innate in human behaviour of not such a few.Crime and law enforcement

Back to the subject of crime: higher than usual levels has often been blamed on the poverty caused by poor and exclusionary fiscal, social and monetary policies.

There are of course more layers and underlying factors unique to the history of political climate and resource allocation.

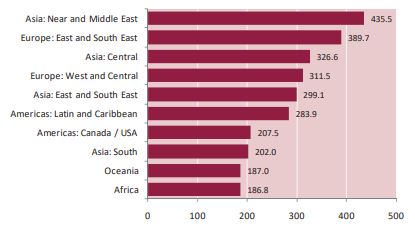

Further studies (such as that in the Freakonomics book) need to be carried out such as the potential effects of police presence in deterring crime in the diagram below:

Police officers per 100,000 population by regions and sub-regions (medians)

Source: www.unodc.org

Also, highly recommended if you are a law enforcer, economist, government official, or student, is a book entitled Economics of Crime by Erling Eide, Paul H Rubin & Joanna M Shepherd.

This book covers the theory of public enforcement including probability and severity, fines and imprisonment, repeat offenders, incentives of enforcers, enforcement costs and enforcement errors.

It might shed some light as to how criminally-inclined people can be dealt with once and for all. Because as we know – whatever government is doing to fight crime now is clearly not really working!“When crimes are left alone long enough to fester, a second economy is borne.”

The proceeds from a ‘secondary’ economy because of criminal activity never benefit society. Even though people like Pablo Escobar were seen by locals (in his Colombian town) as philanthropists, their assistance came at a price. Such contributions which are naturally tax-free generally are referred to in economics as ‘social ills‘.

A third market is formed – one comprised of the need to feel secure.Dealing with the scourge

But fighting fire with fire (with more guns & police who are sometimes corrupt themselves) will not alone solve the problem.

Criminals simply become more aggressive when met with a more confrontational approach as seen in South Africa. The Jeppestown (Johannesburg) shoot-out in 2006 for example, left several police officers and criminals dead.

It’s time to get ’smarter’ about crime and look to the accuracy and conclusive study of human behaviour and the use of incentives.

As crimes continue to ravage communities, cities and countries, we can question why government officials have relatives who own or have stakes in security companies.

It basically places less of an ‘incentive’ for officials to do much about crime.

So, conceivably, those with such vested interests in the third economy would need to be weeded out of the system for crime to be curbed.That would be the first major step in order to bring about some rationality to society.

-

For investment gains or for purpose?

As much as institutions, risk-averse, or simply skeptical people have downplayed the new digital currency revolution. It still, a decade after coming to public light, remains resilient.

Bitcoin now gets a regular mention in daily news and stock market reports. It is being traded by several established investors and even included by fund managers as high-risk portfolio instruments.

We all by now, have heard the rhetoric of high volatility and use for criminal activity when it comes to Bitcoin and its crypto-family.

Billionaires Warren Buffet and Bill Gates also weighed into this by publicly lambasting Bitcoin. Buffet equated cryptocurrency to rat poison 🙂

Be it may, digital currency, however, does have some unbeatable benefits and functions you cannot ignore.

Financial emancipation

Bitcoin and ‘altcoin’ investing have created a new wave of financial investors.

These include retired bankers, ‘millennials’ – who instinctively jump on-board a new discovery that has creative destruction-like tendencies. You also have the plumber, bartender, or ‘average man on the street’ looking to change their lifestyles instantaneously.

Based on their phenomenal returns, many people have taken to social media (via groups, profiles, and communities) to share their success stories. But this is also a reason to for you to heed caution when you take counsel from anyone claiming to be an expert in cryptocurrency investment.

Volatility is not new to trading – and especially not with Crypto trading. It is constantly on a rollercoaster ride making it hard for even seasoned trading experts to predict movements with traditional market analysis tools.

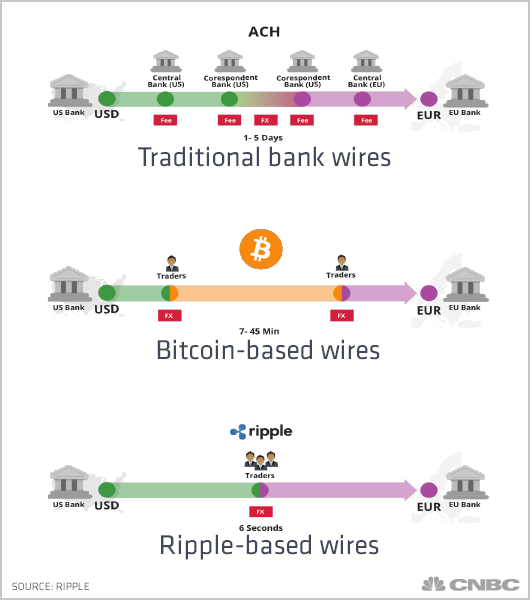

Money transfer

We all have undergone the painful stress of waiting for funds to clear so your rent gets paid or waiting endlessly to receive money from abroad.

With cryptocurrency, the aim is to be not only the most secure form of funds transfer – but the fastest.

Converting cryptocurrency to fiat money, however, remains a bottleneck. It still needs institutions to adopt or directly accept payments in cryptocurrency to avoid you going through another step in order to transact.

Cryptocurrencies still cut down transfer time significantly compared to traditional electronic fund transfers of fiat money.

Some well-established companies already use Cryptocurrencies like Bitcoin, and Litecoin for fund transfers, or even direct exchange for services.

Cost savings

We cannot ignore the reduced costs associated with dealing with money you have (hopefully) earned from hard work.

Even inheritances are gained because of the toils of the giver’s hard work. So, it wouldn’t be fair for a group of a few companies headed by executives to siphon it from you while claiming to ‘provide you with a service’.

We all pay for Internet use (and the security software associated), for smartphones and computers.

We, therefore, have the technology to make transactions ourselves without having to rely on others to charge us for things we can do ourselves.

The financial institutions have long preyed on your ignorance, obedience, and unquestioning trust. This, while they brazenly burn cash dabbling in equally questionable high-risk investments like derivatives and futures.

Use cases

Cryptocurrencies have nevertheless, got us thinking about making profits, the tax implications, and anything financial for that matter!

A recent development called Hodl Waves attempts to track and predict Bitcoin movements via complex usage history. It basically compares behavioural patterns of what you do when you have coins and when you choose to reinvest them.

Blockchain technology has also spurred a new path of careers and industries. More companies globally are looking to acquire lucrative Crypto-exchange licenses to operate.

These cryptocurrency exchanges require people to service clients in various areas. They will require employees as any company would.

Governments too will benefit from their operations. While there are still discrepancies in most countries about how to tax you, authorities can get a lion’s share from directly taxing exchanges.

A new wave arises

It is only a matter a time before the banking institutions and big companies get on board to benefit from the high-level encryption and speed provided by digital currency.

To conclude, the ‘wait and see’ mantra is all that we can exercise when predicting the future of digital currency.

There are, however, concerns on how secure the encryption can remain with the advent of quantum computing. This ground-breaking tech can make calculations at millions of speeds faster and thus able to crack the toughest data encryption.

Some form of regulation would be required in some form to keep Crypto prices stable.

-

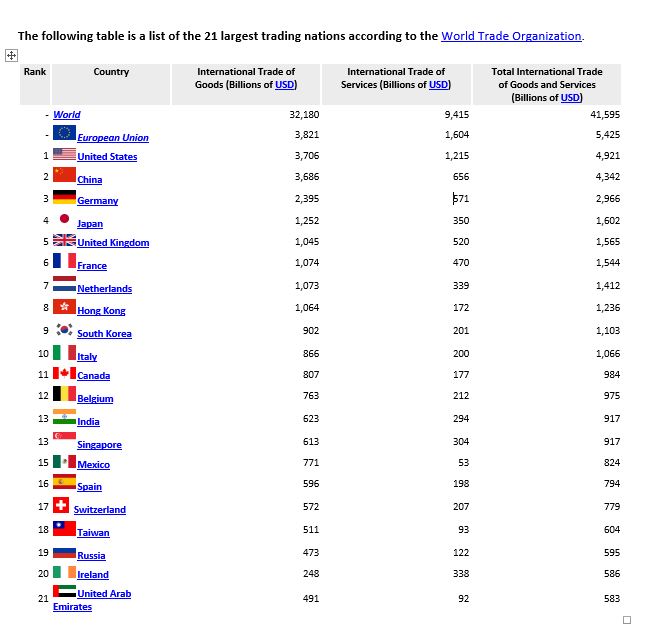

The fuss about trade disputes

What does a small-scale farm-holding, two presidents, some tech companies, and their respective local currencies all have in common?

The answer might be obvious if you have been paying attention to the so-called trade war between China and the US in the news lately.

But why is it of concern and what are the far-reaching implications for the rest of the world?

Active involvement in international trade is a vital sign of your country’s financial health and boosts its Gross Domestic Product (GDP).GDP measures the value of all goods and services produced in a country. From raw materials (input costs) to value-added (assembly and skilled labour costs) to come up with final goods or services.

And though “domestic” implies that this refers to your country’s internal economy, the contributions can be extended from a services perspective.

This occurs when your country places emphasis on or relies on income from Foreign Direct Investment (FDI) to help boost its economy via its GNP. GNP is a similar measurement but slightly different from GDP as it incorporates.Importance of trade

Fact is, all our goods and services come from unit price or costs that arise from the initial extraction of raw materials.

These then undergo production leading to the product or service of intrinsic value for both local and international (via exports) consumption.

An ideal situation for your country is to export more than it imports to maintain a positive balance of trade. So basically more money flowing in than out.

The trade surplus is then plowed into your economy via the fiscal budget. It can supplement a shortage of funds raised from domestic taxes.

The opposite, which isn’t always a bad thing, (trade deficit) would have to be managed and nursed like any other loan.

The US has often criticized Germany for exporting a lot (cars, trains, and machinery) but not importing much. This is deemed not being ‘fair’ in trade practice. But trade itself arises from market forces, priorities, and consumer demand.

We all love a BMW, Audi, and Mercedes Benz. So these German-made products will always be in demand compared to US car makes.

Who you chose to trade with gives rise to favourable balance of trade if you are engaged in a trade agreement or a trading bloc.Why this is also a big deal

The demand for your country’s goods and services will directly impact the strength of its local currency. More trade means more of your currency is required to pay for goods and so its value goes up.

A strong local currency leads to stronger purchasing power for its citizens and residents. Comes in handy when you plan things like holidays, purchase goods online, invest or just send cash abroad as gifts.

So, you can see why a strong Dollar or Euro is always favoured and why sometimes drastic measures are taken to keep it that way.“A higher demand for your country’s products has a direct positive impact on its currency and exchange rate”

A quick glimpse of the world in terms of the input costs for goods and services gives it a competitive edge when it comes to trade.

- US – intellectual property, services, weaponry.

- Germany – steel and engineering machinery giving rise to high performing automobiles.

- Many African countries – mineral resources such as oil, tobacco cocoa, and precious stones.

- Israel – military intelligence.

- South America – agricultural produce.

- India – IT and customer services.

- China – agriculture, building/(manual) labour, and of late technology.

The beef with China

The technology that China (no.2 on the list) offers the rest of the world is the subject of hot debate. The alleged theft of US intellectual property for tech gadgets and software by China.

This is one of several unfair trade practises and motives for why the US recently decided to start imposing heavier (punitive) tax-like increases on multiple goods imported by China.

These extra costs, referred to in trade terms as import tariffs, have a spill-over effect on the costs of production.

China then reciprocated by hitting the US with tariffs (on agricultural produce) causing the trade war that drives each country to protect its own economy.

The higher input costs naturally, lead to the price of your product going up and reducing its competitive advantage and demand. Higher input costs can also affect your local labour force for the worse too.

Factories, multinational corporations, and industries such as farms (both commercial and subsistence) will have to cut the cost of labour. In worse cases which we have seen, workers are laid-off in a heartbeat to stop or prevent accounting losses.

These factors would have hopefully been taken into consideration by the respective leaders before pulling the tariff triggers. Acting with emotions rather than looking at the far-reaching implications is irresponsible.

Have the talks of the trade war impacted productivity and the global trade economy? So far it’s just the stock markets (securities and commodities) reacting. Only time will tell.