Let’s face it, if you really were going to quit Facebook, you would have a few years ago. Fact is, you should have asked the serious questions when the ‘free’ social media platform started turning over millions and even billions of dollars in revenue. No free service can generate that amount money out of goodwill and thin air – so much that they could list on the stock exchange. So, we are not quite sure why everyone is acting amazed or why the knee-jerk #DeleteFacebook campaign is only now coming to light.

There really is no such thing as a free lunch and if you believe that all these online social platforms – who may have started off with sole intentions to provide a free service, would keep it that way, then you are as naive as they are hoping you to be. Think about it, the companies behind the platforms, actively recruit in pretty much tens and hundreds of cities globally. And the simple fact of the matter is that in order for them to pay all their (global) staff of programmers, developers, executives, lawyers and other stakeholders – they need revenue.

Facebook, Google, Twitter, Snapchat and pretty much any social media platform that has over 100 million users, therefore, sit on a goldmine for advertisers. The commodity, however, is not just what their users wish to own in the short term, or their purchasing power directly for that matter. The commodity is simply you, the user. So, your preferences, habits and views along with their personal data are analysed via machine-learning systems to study behaviours and habits for constant revenue maximization or in some extreme cases: political, psychological and social manipulation!

“Your ‘payment’ on a social media platform is your consent to have your information used for marketing purposes – opting out of marketing would give you true free use of the service. But no profiteering company offers that privilege today – the best you can get is a month’s free trial.”

Knowing your likes, spending habits, music preferences, political views, personal information including location and working habits is enough for any company or institution to cater their goods and services and position them (sometimes subliminally) into spaces where you are likely to indulge in them. Social media platforms, in this case, become the marketplace for them to ‘mine’ data to use.

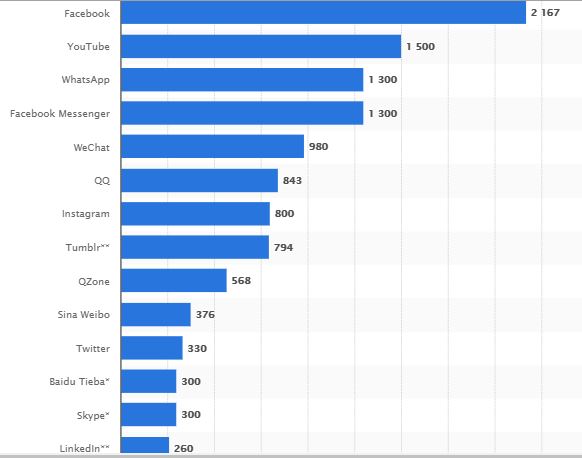

Most famous social network sites worldwide as of January 2018, ranked by number of active users (in millions).

Source: © Statista 2018

Data mining is not a new idea and completely legal if presented transparently in the terms and conditions of any service – which are getting longer by the day (and smaller in print) that we don’t bother to read them. In fact, Microsoft envisioned this a decade ago and changed the way its operating systems work (beginning with its Windows 8 series), to more of a social, interactive and information gathering system – designed to “help you” organize things better. This is fostered by a voice-activated app called Cortana – all under one Microsoft account.

Amazon has its own ways of data mining via your shopping habits and Alexa – is own voice-activated search and information-providing device. Google (owned by a group called the Alphabet company) has the biggest stranglehold of the lot and must, therefore, be the most cautious when it comes to data privacy and security.

This applies especially with its partnership with Android, which makes it a requirement to use for all their devices (phones and tablets) to link up all your data including phone contacts, emails via Gmail, pictures via GoogleDrive, apps (music, movies and games) orders via the Google (Play)Store and social media via Google+. You can even have your search fields stored and synced onto your devices – from your laptop to phone and tablet via Google.

You are now having to (almost mandatorily) give up your telephone number, location, and other preferences indirectly to unknown affiliated marketers and partners of the tech giants who are getting first dibs on this data – and paying good money for it.

The main violation by Facebook, therefore, might not even be non-consensus selling of data to marketers, because such things could be countered with a clause they may have strategically stuck in while you were busy posting selfies and liking random videos of cats making funny faces. The real issue is the potential use of the data for political or advanced manipulation of data for fraudulent purpose with the use of sophisticated and artificial intelligence to influence you without your knowledge.

Read more about the uses of Artificial Intelligence here

Full data privacy, though not conceivable, and absolute freedom from advertising on social platforms is possible – but at a cost. This was reiterated recently by the COO of Facebook who admittedly confirmed that opting out of the terms to have your data sold or used would lead to you having to pay to use Facebook in future. They had just not put this in place but will now forcibly have to make it a clearly visible option.

The fact of the matter is we are in an era of Big Data, Internet of Things (IoT) and AI – all which require data to analyze. These platforms are thus here to stay and still serve their specific functions well. More importantly, they’re also the livelihood for many small-to-medium-sized businesses. Though many were reluctant at first, pretty much every company now has a Facebook, Twitter or Instagram page to showcase and communicate with their clients via the newly termed phrase ‘social engagement’ – a strong branding and marketing tool.

The fact of the matter is we are in an era of Big Data, Internet of Things (IoT) and AI – all which require data to analyze. These platforms are thus here to stay and still serve their specific functions well. More importantly, they’re also the livelihood for many small-to-medium-sized businesses. Though many were reluctant at first, pretty much every company now has a Facebook, Twitter or Instagram page to showcase and communicate with their clients via the newly termed phrase ‘social engagement’ – a strong branding and marketing tool.

And if you think you are out of it by leaving one platform, just remember this: Facebook owns WhatsApp & Instagram; Google owns YouTube; Microsoft owns LinkedIn and so on – there is nowhere to hide if complete online privacy is important to you. And let’s not forget your web-browser – not many people actively use ad-blockers unaware that even their browsing data is being scanned and processed always by external third-parties companies.

If you aren’t using a Virtual Private Network (VPN), you should seriously consider it along with some good (some free) plug-ins to help secure your online browsing from all types of behind the scenes snooping and ransomware.

It will be interesting to see the outcome and verdict of the probe into the Facebook case and rest assured, many other heavily used platforms will be deleting and removing ties with data mining marketers that have had a similar agenda to what Cambridge Analytica was accused of conducting.

A change in verification of marketers, data storage, management and data security laws (such as the new GDPR law targeting businesses coming in May 2018 to the EU region) were long overdue, and Facebook will now be the scapegoat to enforce data security laws on social media.

If that sounds impressive you will be further astounded to know that even lower grades of the coin such as the proof 66 5 Rand Mandela cost 735 Rands ($62) in 2006. It then commanded growth of over an astonishing 900%.

If that sounds impressive you will be further astounded to know that even lower grades of the coin such as the proof 66 5 Rand Mandela cost 735 Rands ($62) in 2006. It then commanded growth of over an astonishing 900%.