With all the negative and positive commotion surrounding the Crypto market – it still begs the question, for those still curious. What does it take to engage in the trading of Cryptocurrency?

And by trading, we are not referring to the price speculation in a portfolio as one would with the price of a company’s shares or even CFDs.

We are rather referring to trading it as a commodity against other ‘Cryptos’ in a properly regulated online market setting. Similar to how a Foreign Exchange (Forex) market operates.

As with trading traditional fiat currencies, the price is purely determined by good old supply and demand for the currency and monitored by the availability versus volume traded.

It is therefore just a medium between traders where they can set limit orders to buy/sell Bitcoins for a certain price.

So, in the true approach of Debunqed, we will decipher crypto-exchange trading by looking at what you need to do to get into it, and what you stand to gain.

Here are the quick steps:

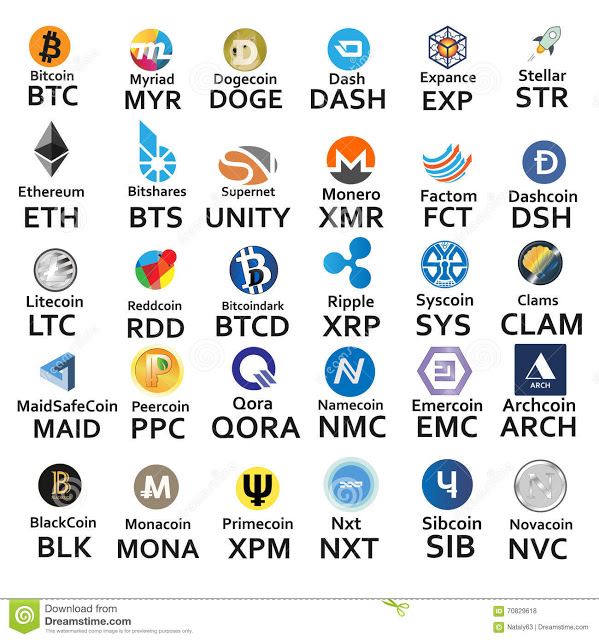

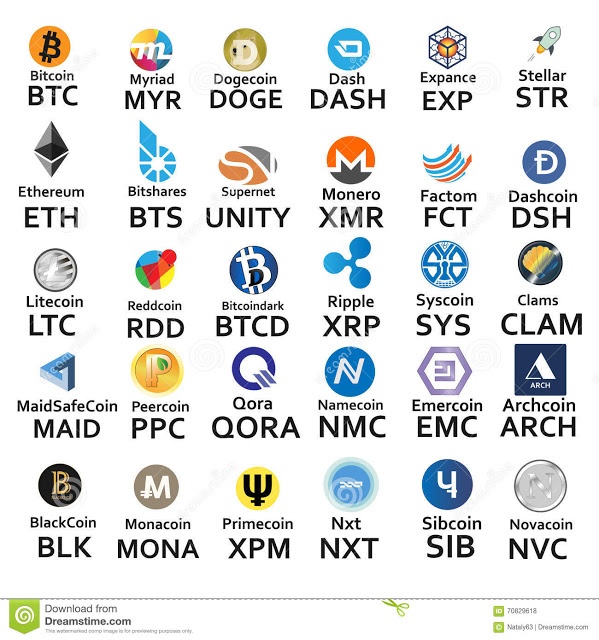

The first step would be to open a secure Crypto wallet to physically purchase (own) some altcoins. Bitcoin, Ethereum, and Litecoin are the main coins offered by Crypto wallet providers.

They hold the most value and can thus be broken down into smaller denominations (Altcoins). The same way the dollar is used as the main exchange for other fiat currencies. This example helps to put things into perspective.

Make sure you do your research into which wallet you will use. Obviously, if you are mining a certain Cryptocurrency you would naturally purchase them directly from that software provider of the Altcoin.

Using Ripple mining as an example, the platform is supplied by RippleNet and naturally, it follows that the Ripple company mines all the volume and controls its supply.

Getting the digital currency into a wallet can be a quick exercise.

It can take as quickly as between 5 – 20 minutes via a peer-to-peer Bitcoin marketplace connecting buyers with sellers like at Paxful.

Make sure you deal with reputable sellers. This wallet provider rates suppliers based on how reliable they are so only deal with sellers of the highest ratings.

The actual purchase (mostly conducted via online chat) can be made via a Credit/Debit Card, online banking or convenient money transfer facilities like (Europe-based) N26 Bank, Skrill or PayPal.

You can even purchase and send gift cards from Amazon for instance, to the seller (to the value of the currency being purchased) for the seller to release the Altcoins.

Security and storage

The actual coins are stored as an alpha-numeric key code – with the currency value in the wallet once acquired.

This after the wallet-broker takes a small fee for the transaction. This code/key needs to be kept secure – backed up online and offline (highly recommended). This is possible on special flash-drive (Crypto wallet) like the Trezor or a Ledger Nano. The device would hold the deposit key if you were transferring it to another wallet or to an exchange to trade.

Time to go shopping!

Finding a good exchange

The next step would be then to source a robust and user-friendly platform to trade your newly acquired currency on.

The best cryptocurrency exchanges would allow you to swap fiat currency such as dollar/euro for the digital currency directly. Naturally, you can trade one digital currency for another as well.

There are quite a few to choose from so it is good to read the reviews. You should then select one based on the number of deposit/withdrawal methods, the fee structure level, number of countries served, availability of security tools and features.

The last aspect is a huge determining factor: exchanges can be prone to hacking, or loss from outages. Lastly, their margins and exchange trading functions are good to observe too.

For serious and equally secure trading, you will likely need to use an exchange like Binance that requires the user to verify their ID before being opening an account. Make sure you have all your documents ready and up to date!

Trading

When it comes to the actual trading, let’s take a scenario where two people want to sell an altcoin but not for the market price. One sets a limit order for lower and the other for a slightly higher price. So, the best price to purchase Bitcoins, in this case, would be the median of the two prices.

If the buyer wants to purchase more than one altcoin, they will continually take the lowest price available. By doing this, the “price” of the altcoin will increase as the lower-price sell orders are no longer available.

You will then, as with Forex, purchase pairs of where you think your digital currency will be stronger against another e.g. BTC (Bitcoin) vs XRP (Ripple).

This combo would look like this on the exchange: BTC/ XRP – 0.00011960. What this means is that one Ripple coin is worth that much Bitcoin for instance.

The little details

This type of trading, like commodities or forex, requires constant attention and the monitoring of prices. But there are tools that can also help you set prices and have the trades auto-execute.

So, a platform which provides such tools conveniently allows you the time to do other important things. Like paying attention to your spouse, formal job or family and friends. That would be ideal.

If you have the cash, time, expertise and financial clout, it is even possible to run your own Crypto Exchange!

This is another benefit of a decentralized currency system that will allow you to earn some cash by charging for the usage of your robust platform.

Well, this may be until the fiscal authorities’ crackdown on all of the platforms with restrictive legislation.

Finally, like many platforms that provide opportunities to purchase something, the software must be stable and be cost-effective to use.

ADVERT