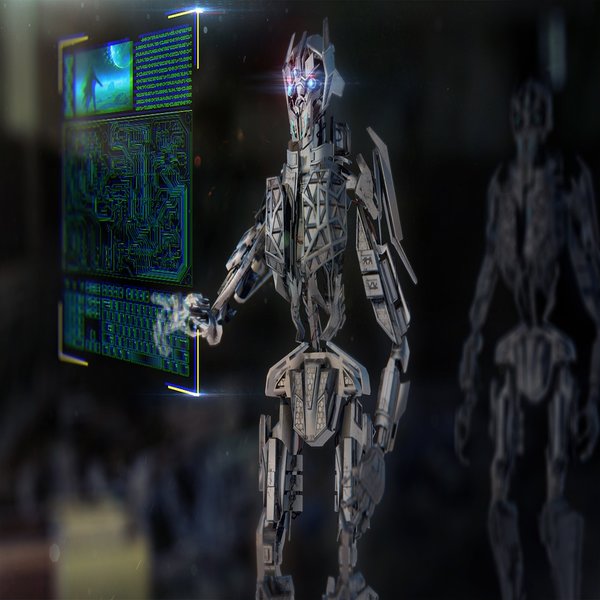

The Future Office Worker

Aside from essential services personnel, millions of people are now working from home. The Covid-19 pandemic has prompted the growth of products to help the home office worker of today and tomorrow. Debunqed breaks down which cloud solutions to pay attention to and which to avoid while you adjust to a changing world of commerce. […]

The Future Office Worker Read More »