In a few years from now, cash may no longer exist. Instead, we might be using microchips in our hands which will communicate with a digital currency system. As humans, we want things (and processes) to become more uncomplicated. That is how we measure progress.

Right now, technology facilitates economic activity but may soon supersede the need for faulty monetary policies (by creating more efficient economies) in the long run. Robert Solow was right all along. Despite this, we still use archaic paper currencies. This form of legal tender, however, in a decade or sooner, might be replaced by another official means of exchange of many nations – or at least be in heavy use.

Society needs a safer, easy-to-use means of exchange and incidentally, as you read this, digital currencies are being designed and studied at Universities and information technology ‘thinktank’ companies the world over.

It would require a monumental shift in thinking for people to stop using cash at all. At a human level, it seems simple. Paper money is (literally and figuratively speaking), dirty and it takes up space. It’s also possible for cash to cause stress as when you have it – you have a target on your back.

So, what could replace cash?

Central Bank Digital Currencies (CBDCs) are currently in hypothetical planning stages with some countries conducting proof of concept programmes. CBDCs are a means of monetary exchange (by a Central Bank) that exist in a digital state on a server in a cloud.

The idea of using a CBDC was prompted by the emergence and prevalence of Bitcoin and other cryptocurrencies. Believers in the mass use of CBDCs want the world to use less cash. They believe people are safer if they do not have money at hand, which can be stolen, and that commerce can be more efficient in a cashless society.

You can read more about the role of Central Banks here

We could say that the history of money is a story of its gradual dematerialization from tangible objects to intangible computer code. Programming code is written for and used to facilitate many facets of our lives, so why not with money?

An ETA is sooner than you think

Over time, what has been used as money has changed, starting from trading large objects which were seen as a basic store of value. Gradually people started shrinking those objects into paper and then turning paper (IOUs) into a special paper. Later, they formalized the process by setting up a financial system to support it – Lo and Behold – the adoption and use of cash was borne.

Some progressive nations have shown genuine and committed interest in testing the viability of CBDCs. Seven Central Banks in October issued a statement in which they said they were studying common principles and salient features needed for a viable CBDC.

The Central Banks in Canada, Britain, the European Union, Japan, Switzerland, Sweden, and the United States now believe there is a threat that private digital currencies pose to the control of monetary policy.

More specifically, they are also competing with China, who they purposefully excluded from their group. They plan to have a viable digital currency system to prevent a case in which China gets the first-mover advantage.

Advantages of CBDCs

We want to create a more efficient payment system. Managing cash can cost money mostly because of securing the safe use of it. We can include more people in a financial system as there is no need for consumers to have a bank account to hold a CBDC.

Safety is, therefore, a huge “positive” to having a cashless society. This is especially in emerging countries where many people still use cash as opposed to cards and electronic transfers (ETFs). Cash is trusted while banks aren’t necessarily trusted at all. Consumers also might not want to pay fees to keep their bank accounts open.

One salient case for a contactless (digital) payment system would is due to the advent of the Covid-19 virus. This has awakened us to the potential emergence and spreading of potential viruses in the future.

CBDC might also make micropayments cheaper which would allow for new services and business models. So, one can enable the efficient sale parts of products and services, such as individual news articles or television series episodes for a few cents rather than relying on subscription models.

A CBDC may also reduce friction between payment systems and increase the speed of transactions while ensuring their finality. This can be achieved by achieving delivery versus payment in securities transactions.

Issues with digital currencies & CBDCs

Cryptocurrencies currently exhibit huge swings in value (volatility) as people use them as a speculative asset. This could change if they were somehow monitored and administered by Central Banks.

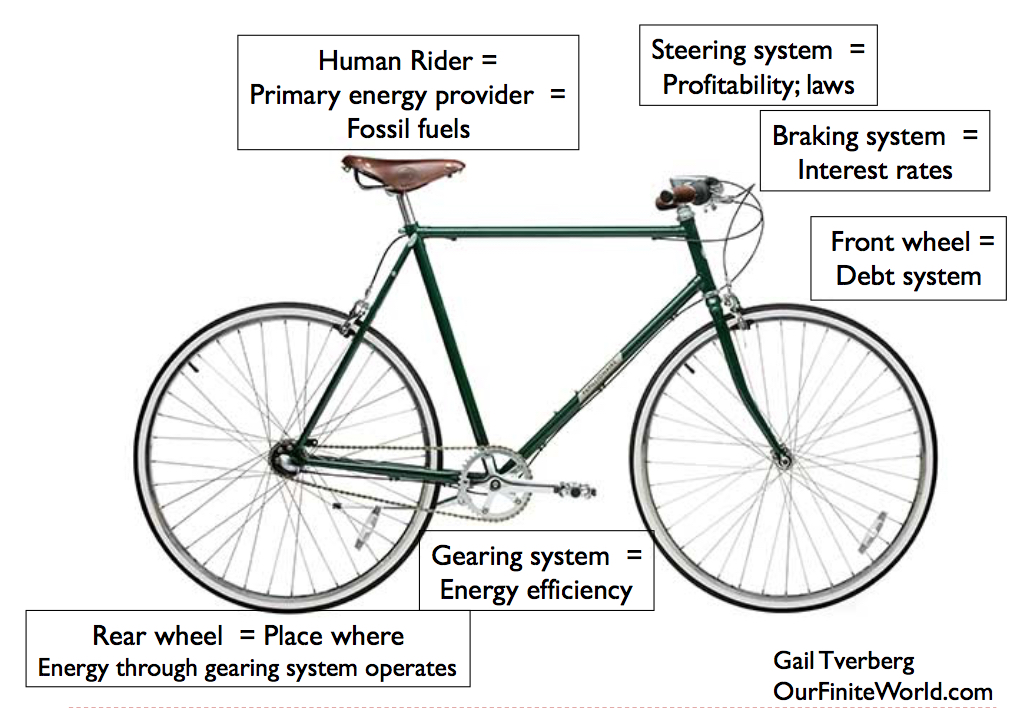

The disintermediation of commercial banks would occur if consumers move money from bank accounts into CBDC. This could start a vicious cycle as banks raise deposit rates to attract more money and less bank credit will be extended at these higher interest rates.

A Central Bank could need to provide additional liquidity to banks and hence take on credit risk. There could be an increased reputational risk for Central Banks.

Digital systems need to be protected and the system’s staff monitored.

Many questions remain unanswered

Cross border transactions will also create new paradigms for central banks. There are risks of a type of dollarisation for economies with volatile exchange ranges and high inflation.

‘Dollarization‘ is when a country replaces its currency with the US dollar because the dollar is so stable and widely used. In the foreseeable future countries may then opt to replace paper money with the best (continental) CBDC available – like a digital Euro for the EU.

The future depends on the goals of the CBDC. It would grant the public access to the state’s balance sheet when, right now, cash is the only way for private individuals to hold central bank money. All other types of money holdings are based on centralized/private money creation systems. These are still prone to manipulation and abuse by central banks themselves or their subsidiaries.