We can change our dependence on certain goods and services so that we don’t take too high a knock when their prices fluctuate.

Life is about making choices. As rational beings, we tend to make choices that benefit our wealth and well-being.

But some choices have to be made on our behalf — especially when it comes to the provision of commonly used goods and services.

What is elsaticity?

The prices of government-regulated products such as fuel, alcohol, and cigarettes are examples. How we react to the price change (whether an increase or decrease) is referred to in economics as elasticity.

It is a general term for a ratio of change and scientifically attempts to capture your sensitivity to price movements. It is the percentage change in the quantity demanded (or supplied) of something brought about by a percentage change in its price.

A 10% increase in the price of bread, resulting in a decrease in the quantity demanded by 8%, means your price elasticity of demand for bread is 0,8.

The ratio is expressed as a number between negative infinity and infinity, with one being the midpoint. The number has no unit — it is not expressed in centimetres, litres or as a percentage.

But that number tells us a great deal. If it is higher than one, the product is said to be elastic. This means the quantity you demand responds strongly to price changes.

Anything under one is inelastic. This means a price change doesn’t affect your demand for it much.

When a product is said to be unit elastic, it means the change in quantity demanded is equal to the change in price.

Practical examples

On the commercial side, the concept becomes more useful when formulating and studying consumer trends. It is especially beneficial to brand managers who need to set prices for their products while paying attention to sales.

Income elasticity of demand measures the responsiveness of the quantity of a good to changes to your disposable income.

Generally, the more inelastic the product, the easier it is for firms to maximize profit by increasing their price.

Taking advantage of addictions

If you’ve ever wondered why the prices of your alcohol and cigarettes — commonly referred to as “sin taxes” — always rise, it is because they are inelastic.

If you were addicted to nicotine, for instance, you would rather cut down on movie tickets to still afford a box of smokes. This makes you inelastic to the increase in cigarette prices.

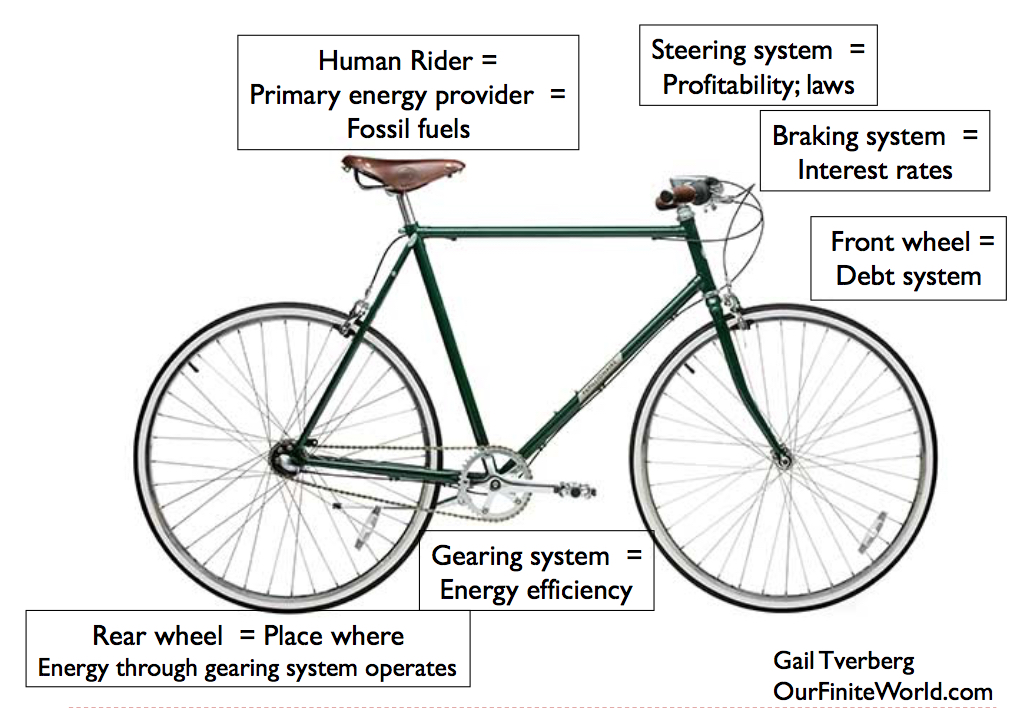

Likewise, we industrialize, we become heavily reliant on oil. Our dependence on oil was reiterated in the latest Organisation of Petroleum Exporting Countries (Opec) oil outlook, which paints a gloomy picture. The West’s demand for oil is predicted to surpass the available supply in the coming years.

Globally, over the decade of 1994-2004, about five times more passenger cars appeared on our roads than commercial vehicles. In South Africa, alone, commercial vehicle sales for July were up 13% in the same period.

Concurrently, increases in lorry volumes worldwide have been observed.

The more inelastic your product is, the easier it is for you to slap your consumers with high price increases.

At the time of writing in 2007, the oil price once hovered around $73/barrel and threatened to reach a record high of $80*

Concluding remarks

By using other means of energy (oil substitutes, wind, electricity, and solar) we could reduce our reliance on oil. this would make it less inelastic.

In South Africa, for example, using trains for cargo transport would ease our dependence on petrol and diesel-powered commercial vehicles.

Carmaker Tesla recently launched its future truck and alleged fastest production car in a big to reduce our reliance on fossil fuels. Tesla is gaining steady ground to introduce its electric cars to the world and has surpassed the net worth of Ford.