We end the year once more with trading: a topic that might not be directly tech-related. It, however, relies heavily on online technology to help with investments and therefore, is noteworthy.

More and more millennials are getting into the habit of adopting get-rich schemes. You just have to look on Instagram and Twitter to see how gullible some of them are to Ponzi-like schemes preying on online and financial naivety.

It has become so cumbersome as most of the predators ‘befriend’ you only to present you with the offer to trade (Forex, Binary options, or mine Crypto) on your behalf. Some blatantly just ask for you to deposit cash (usual increments of $500) into unknown accounts!

Nothing to perform due diligence is available and not even a website sometimes – just the promise of profits of up to 30-80% weekly, monthly, or whatever – it’s all clickbait!

Capgemini’s World Wealth Report 2018.

A notable 60 percent of high net worth individuals (HNWIs) in Latin America alone showed high-interest levels in Crypto investments in 2018.

You can, however, as we mentioned around this time last year, take full control of your financial destiny.

When it comes to managing an online portfolio via a broker such IQOption, there are a few things you have to consider first before dropping cash into your trading account.

Checklist

Research

- Equities (Shares or stocks, ETFs, Commodities, Indices, Options, Forex, Futures, and Cryptocurrency). These are all vehicles you can engage with concurrently in the same portfolio. They all also have their (moderate to extremely high) levels of risk. Learn how each of them works. Shares are actually the less risky of the batch nowadays.

- Have a plan! One does not just opt to invest in equities to “make money”. Of course, you will make (or lose) money. The question is how much and within what timeframe? When are you looking to have the money back? These questions will help determine what kind of investor you are or the approach to adopt when investing.

- Based on your knowledge, appetite for risk, and the associated costs, you will either be a long, mid (mixed), or short-term investor. The latter is referred more commonly to as day-trading. Long term trading works pretty much like savings. You buy the stock/share and hold it for a long period of time (shares/stocks and indices are the best vehicles for such). All the others can be bought and sold by the minute, hour, day, or weekly.

Setting up

Setting up with your bank means there is also less admin when it comes to verifying your personal details such as ID, physical address, and so on.

Be sure to have all documents ready and up to date. These are mandatory and required by local financial authorities to help prevent or determine fraud, the use of securities to launder money, or fund terrorism.

The bank trading brokerage fee can be waivered by going for an online broker independently if you have all your ducks (paperwork) in a row.

Costs

Once set up, there are further internal costs that the broker will charge you. Pay attention to the commission charged when you purchase security of choice. Some waiver it but then charge what is called a spread. Then there are other deductions such as a charge for borrowing money to trade – what is termed ‘overnight fees‘.

And of course – pay attention to TAX!

- Pay attention to all the associated costs. It costs nothing to setup an online trading account via a broker. Your bank may charge a brokerage fee for running a separate trading account. The advantage of that mainly is just the ease of adding and withdrawing your ‘winnings’.

We strongly recommend actively running a trial for at least 2 months before making your first deposit to start purchasing securities.

Some strategies

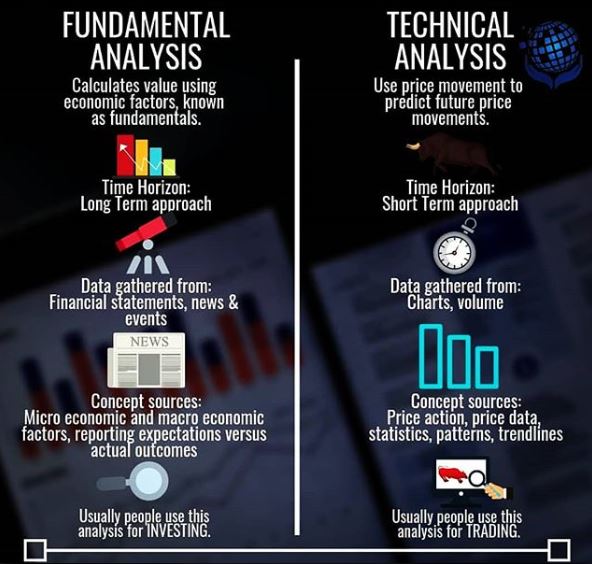

Before that first purchase, you should hopefully, by then, have used the trial period to learn some of the tools. Trading (or investing) is not something you do out of a gut feeling. There is about 3% ‘gut feel’ but the rest of the knowledge comes from studying the tools for technical and fundamental analysis.

The difference between technical and fundamental analysis is the difference between trading and investing – without any, you are outright just gambling!

There are also some ways to mitigate your risk and minimize losses. One system that applies to all investing is called Dollar-Cost-Averaging. So, under this strategy, you divide the total amount into bits to ensure that on average your losses are smoothed out by profits. The diagram to the left illustrates this.

Budget within your portfolio

Always start small and see how that goes before diving fully in. People get greedy and think if $10 fetches a $5 profit then $10 000 would subsequently garner $5000 or at least $500. It doesn’t always pan out that way. If it was that easy we would all be millionaires!

One must also quickly avoid the habit of topping up the account to get the next hot stock because like a business, your trading portfolio is an investment for future growth. It must therefore, be nurtured that way.

Ride the waves (with your initial investment) and reinvest your winnings by ploughing back some of the profits into less riskier securities once you make a small ‘killing’.

Switch from a short to medium term trading approach to secure your profits. Many day traders end up losing all their gains because they stay in the game for too long. The stock market always turns eventually and gets its pound of flesh!

As a rule of thumb, purchase only after a massive drop in price – as you would in a fashion sale. When a security’s price has risen to abnormally high levels, its ‘bubble’ tends to ‘burst’. In addition, there are tools to measure whether a stock/share or any security for that matter is overvalued. Study them!

Market trends

The markets are constantly in motion and like a rollercoaster, prices are constantly going up and down. You have to choose where (and when) to place your buys (and positions) to make your profits.

Know the market (opening and closing) times so you do not miss a good deal. Many markets will either open with a big rally; cool off in the afternoon and then close with a sell-off (in the red) in the evenings in general.

What causes the up and downs is the buying and selling off respectively.

Based on that, and with the common knowledge that everyone sells at a high profit – what do you then think would happen after a massive rise in the price of a security? It is not rocket-science yet many people fall for it and end up buying at the height (peak) price of an equity.

Easier said than done. Naturally, it is hard to predict where this peak is as many inexperienced profit hunters have found out the hard way.

Markets tend to crash in predictable cycles. The Crypto market fell by a whopping 70% in 2018 – a monumental drop in market capitalization after its equally amazing 2-month bull run. Many individuals and companies who bought Cryptos in January 2018 as a result went down in flames because of such bad timing – and just plain greed.

These are just some of the basics to help you get into an investing state of mind – more particularly with online trading. You will find a few more useful pieces of information on the resources page.

Happy trading and remember to start of with a free trial!