Let’s face it: we’re accustomed to instant gratification in the Internet Age. With the expansion of technology, Amazon order confirmations arrive in email inboxes instantaneously, while hungry customers track the location of their much-awaited pizza delivery each step of the way.

Instant gratification is a sign of the times!

Likewise, if you want to run a sustainable, profitable business in 2019, then digitization is not only useful– it’s necessary. And it’s easier than you think.

Did you know that 30 percent of tasks involved in over half of all jobs could be automated using technology that exists right now?

According to McKinsey & Company, a global management consultancy firm, this number will grow even higher as technology develops–which is great news for your business, your employees, and your profits.

And no, we’re not talking about robots coming to take over your job (although some pretty cool robots exist). From automatic “Abandoned Cart!” emails to payroll and employee onboarding, automation is already a mainstay of modern organizations.

So, looking for inspiration? Here’s just a few of the amazing ways to automate your business.

AI Technologies

Artificial intelligence is taking over the world–and it should be taking over your daily processes. Machine- and deep-learning AI provides a cost-effective solution for both carrying out mundane day-to-day tasks and engaging with customers.

For example, AI-powered bots are revolutionizing customer service abilities by providing 24/7 assistance for regular inquiries and troubleshooting.

Meanwhile, SiriusDecisions, an industry analyst firm, found that sales reps spend only about one-quarter of their entire work week actually selling to customers. The rest of the time–approximately 27 hours each week–is spent on administrative tasks like data entry.

These duties tend to consume a lot of time and energy. Instead, by automating the process, employees could spend their time closing deals and making connections to new leads and investors.

Customer & Employee Relations

At its core, CRM, or customer relationship management, includes all the technologies and strategies involved in these relationships, like email marketing, telephone calls, mail, and social media marketing

If it sounds like a lot — well, that’s because it is. Manually logging all customer data (accurately) throughout the sales funnel is time-consuming and subject to human error. It’s also nearly impossible to maintain communications with every single lead. In those cases, both the business and the customer suffer.

Thanks to automated email responses, data collection, and communications, these problems are a relic of the past. According to a study by Enterprise Apps Today, over 60 percent of respondents believe that automation boosts customer experience. Digitization not only eases business processes, but it improves B2C ( business-to-consumer) relationships, too.

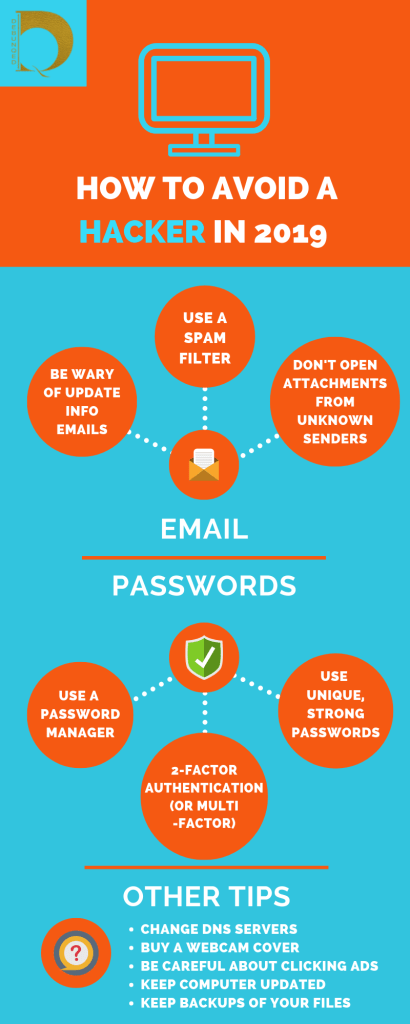

Boost Cybersecurity

Hackers and cybersecurity threats are growing more complex and common every day. Automating your data security systems with AI machine learning can provide a base level of protection while freeing up IT professionals to focus on progressing your business’ systems or confronting only the most complex of threats.

Read more about Cybersecurity here

Reduce Setup Costs

According to McKinsey, digitizing data-heavy processes within businesses can cut costs by up to 90 percent. You can automate everything from employee and customer onboarding, legacy-system integration, data migration, and far more.

Although the initial implementation of automation can take time, effort and money, the payoff is well worth the investment.

Where Should You Start?

To figure out where to start digitizing your business, there are a few questions you should be asking yourself, like: what would improve my customer’s experience and, how can I better communicate with customers?

Further questions such as: which tasks can I automate to save time and cut costs; and finally, how you can ease the daily tasks of your employees in order to better utilize their skills (productivity) are also important points to consider.

Whether you begin with cybersecurity, automating payroll and onboarding, or equipping your site with AI-powered technology, digitizing your small business will lead to happier employees, satisfied customers and a profitable structure for the future.