The adage that whatever you see in science fiction, you will witness in reality, seems to ring true more than ever in the 21st century. In fact, Facebook founder, Mark Zuckerberg is probably one of the biggest believers having bought the virtual reality company, Oculus as far back as 2014.

Now, he and people from all walks of life are embracing the creation and adoption of a “Metaverse”.

But is this a buzz term or a new reality, and are the ultra-rich throwing money at it because they are trying to entertain themselves? Or is it because they actually want to ‘augment’ hundreds of millions of peoples’ senses of reality with beneficial technology?

Like many things in life, the truth isn’t black or white in this regard. While multi-dollar billionaires including Elon Musk and Jeff Bezos have looked to build cities in space that we can escape to when the world becomes overpopulated or uninhabitable, others are developing the ‘Metaverse’ as a complementary set of enhancements and parallel spaces for our lives on earth.

What is The Metaverse?

Is the Metaverse more than just ‘sales speak’ for a bunch of sales-speak-for-tech companies? It has been bandied about throughout 2021 but Zuckerberg has been even more brazen, having announced at the end of October that Facebook would be rebranded as Meta. Rather cheeky!

But what is this swanky new world we may soon be living, and maybe thriving in? I’ve been called Mr. Anderson for over 20 years, so it feels like a fitting time, with the release of the fourth Matrix movie, to ask: “What is the Metaverse(Matrix)?”

The Metaverse is a hypothesised iteration of the Internet, that supports persistent online 3-D virtual environments via conventional personal computing, as well as virtual & augmented reality headsets.

Wikipedia

It’s still being given a concrete definition but essentially it is an advanced version of the Internet wherein we can become immersed. You don’t just look at the Internet; you are ‘digitally immersed’ in it. Instead of just looking at a 3D object on your PC using a mouse to scroll up and down to see it from different angles, in the Metaverse your brain will convince you that you are in the same world as that object.

Metaverses, in some limited form, were already present on platforms like VR-Chat or video games like Second Life. These suggest that we have been moving toward living in a Metaverse for years. But why should we care so much now about the Metaverse then?

Why The Metaverse Matters

The Metaverse has the potential to bring fulfilment, economic opportunity and equity to people. But, for this to happen, we would probably need a situation where a handful of companies – here’s looking at you Zuckerberg – are prevented from dominating it. The virtual world could overcome the shortcomings of the physical one which humanity has lived on for millennia. Digital environments could become actual places where people don’t only live; but also thrive.

It is for these reasons that we believe Metaverses will be pervasive across our lives from a young age until our retirement.

For example, the gaming platform, Roblox might be unknown to well, adults, but this 13-year-old platform is booming. Children and teenagers use this platform to play existing games together but also to create new games. It also sports a marketplace where users can sell those experiences and other products like online outfits and personalized avatars. Another incredibly popular online multiplayer game Fortnite is well poised to switch its huge user-base into ‘Metaversians’. Two upcoming multi-billion dollar gaming platforms built on Blockchain technologies are Decentraland and The Sandbox.

The former made the news recently when a tech company bought a patch of virtual real estate in the Decentraland metaverse for 618,000 MANA (its native currency) – valued at $3.2 million.

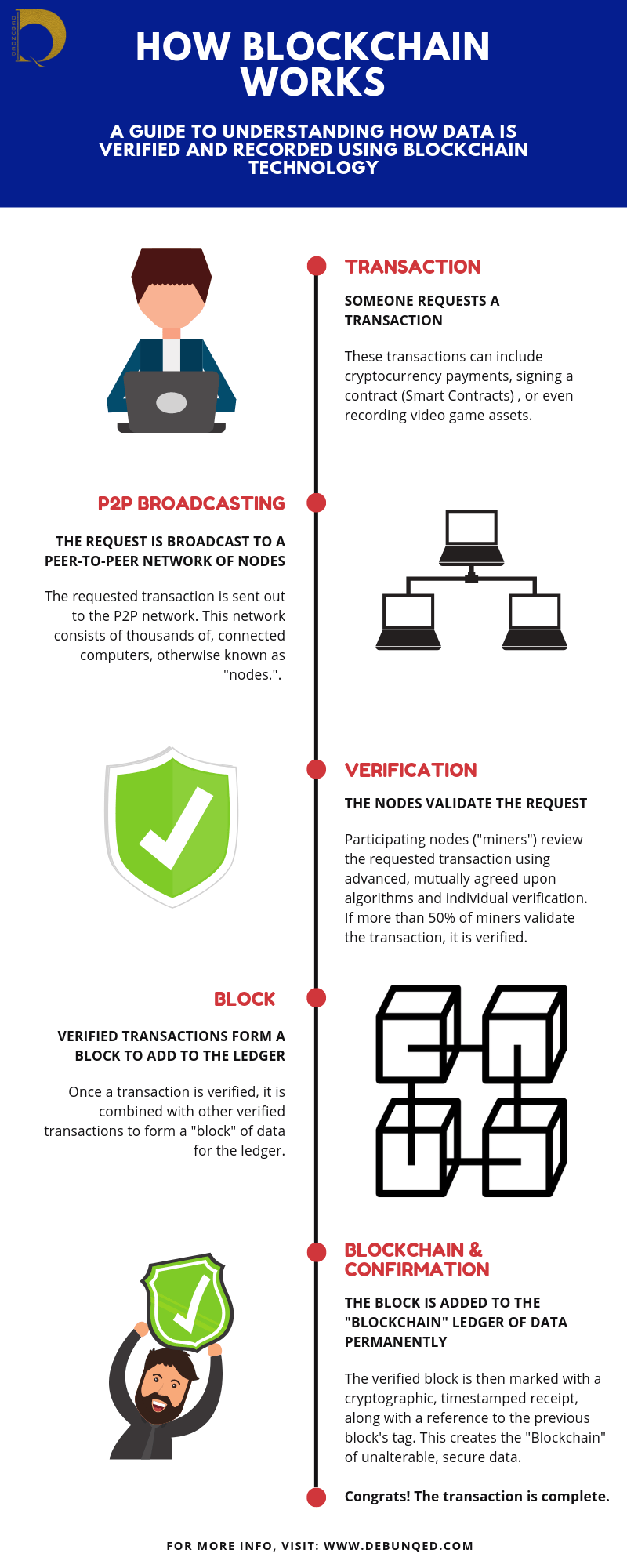

Virtual ‘land’ and other items (digital assets) in Decentraland are sold in the form of non-fungible tokens (NFTs), which are a class of crypto assets. All of these are authenticated using a Smart Contract component of the blockchain.

Play-to-earn is another incentive to getting onto the Metaverse. You will now be able to earn virtual tokens (with monetary value) while emersed in your favourite game. This no-brainer strategy has seen an explosion of Blockchain play-to-earn games in the last quarter of 2021.

Other Use Cases

Back in the “real working world” virtual productivity platforms are also growing as companies’ employees use MS Teams, Zoom and other platforms to be able to communicate easily and at any time.

You will be able to now have online offices and attend online conferences in virtual conference centres while represented by avatars. No more suiting up or wasting time on perfect makeup! So, while one can’t stop people from spending time in a cyber world, we can, however, enhance their experiences using cutting-edge technology.

The opportunities for business and revenue generation will not be limited. Simulations for building and engineering projects will make presentations almost real – without having to travel to the actual sites. Online gambling/shopping companies will also look to capitalise by offering virtual casinos and stores in the Metaverse.

Marketing Spin-offs

There are even talks that companies may sell apparel and clothing and are designing virtual versions thereof. Virtual shoes could become status symbols which is rather bizarre but perhaps fun for the nouveau riche. Joke if you want but brands like Gucci, Adidas, and Nike are prepping (with partnerships) to board the Metaverse for obvious marketing opportunities.

People are rapidly immersing themselves in virtual and augmented reality (VR/AR) worlds. Headsets are becoming more affordable and an assortment of AR/VR programmes are being written daily. These include entertainment programmes for PlayStation 5 as well as for pornography apps (another billion-dollar industry).

Soon the Metaverse will become a tool that improves our lives and will go beyond being just an entertainment novelty.

It doesn’t stop here. There is a little-known Metaverse company currently worth $2bn, that has made some major breakthroughs using Blockchain tech. They have actually created a device to scan entire people and objects to immerse them into the digital world.

The ambitious project, MetaHero will be paying people a decent amount to have their avatars made and used in games from January 2022. Sounds absurd but perhaps you need to take a look yourselves.

Final Word of Caution

Bear in mind that the Metaverse may exacerbate problems faced by humans because of the Internet. We need a better grasp of managing data rights, data security, misinformation, the radicalisation of morally wrong ideas such as racism and vaccine hesitancy as well as platform power.

Somebody needs to rein the likes of Facebook, um I mean Meta, in. We should not just allow the Metaverses to distract millions of us with a ‘wonderful’ cyber world.