Leadership values are not only confined to the running of a political campaign, party, or country for that matter, however, like in any venture that has an objective and deals with human beings – it forms the backbone of a successful business.

Consequently, what leaders such as CEO of Tesla Elon Musk, for example, say or does, have a positive or, in the recent unfortunate case, a negative impact on the shareholdings of his business.

The share price can decline sharply and worse yet, it can lead to the exit of senior staff members and thus undermining the business, its leadership values, and objectives.

This why it is critical for companies to adopt the right practices and responsible leadership to enable them to address both internal and external issues affecting them.

This is even most relevant when dealing with a company that has a multinational operational facet such as the Murray and Roberts Group – a South African company that operates in a global setting.

This specific multinational company was used in a case study for a research paper because it is firmly entrenched in the construction and engineering industry.

More specifically, they service the global natural resources market sectors of underground mining; Oil & Gas; Power & Energy.

Such a diverse set of operations requires a varied set of objectives spearheaded by a solid leadership path.

A new model of leadership

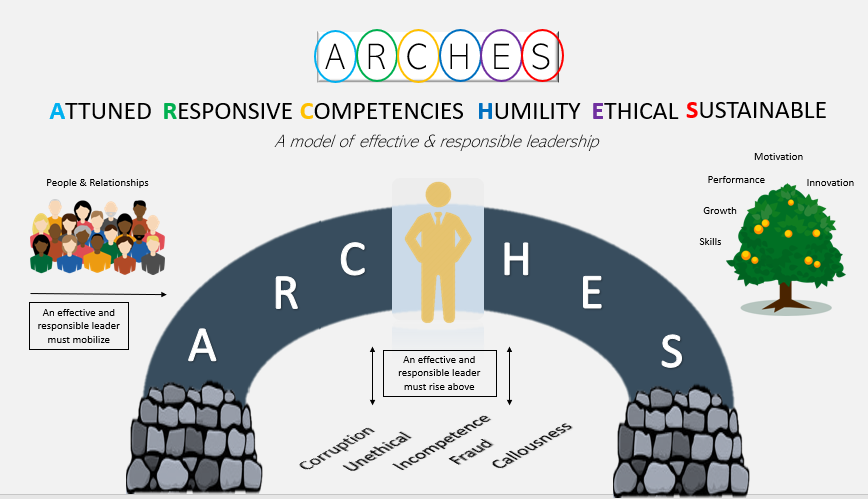

We have covered the topic of Emotional Intelligence before. It now surfaces again within a brand-new leadership model known as the ARCHES model.

The name derives from a key characteristic of the physical structure of an arch and its durability.

Coupled with its diversity in models and materials and its depiction as symbols of triumph, it represents an apt analogy of what responsible and effective leadership should be.

The model was especially derived by an academic* for a syndicate group assignment and is based on six key characteristics that should be imparted in a leader.

An effective and responsible leader is one who is attuned to their followers, responsive, possesses the necessary competencies, serves with humility, is ethical and adopts a sustainable approach to leadership.

A leader who possesses all these attributes is one who can rise above adversity and lead their followers in a way that promotes innovation, motivates, develops skills, promotes personal growth, and encourages improved performance.

B.Moyo

Application of the model

The model defines attuned leadership as the act of being self-aware, informed, and aware of the environment in which you exist – servant leadership.

Employees should be encouraged to take responsibility for their actions because responsibility and effectiveness are complimentary. The demise of US energy company Enron, for example, was due to a failure of management to execute communication-based responsibility, internally and externally.

A volatile, uncertain, complex, and ambiguous environment in which a business operates can result in many potential projects not coming to fruition.

In such an environment, leaders that are attuned, responsive, and possess the right competencies can expert power as their way to influence followers to exhibit the same traits.

Referent power develops out of admiration of another and a desire to be like them. Expert power, on the other hand, is a person’s ability to influence others’ behaviour because of recognized knowledge, skills, or abilities.

This requires the leader to have a tolerable level of humility.

This is defined as a personal quality reflecting the willingness to understand the self (identities, strengths, and limitations). That combined with a purpose in the self’s relationship with others.

Once again, the emphasis on Emotional Intelligence coupled with traditional leadership competencies is needed to steer multifaceted companies.

Even more so when dealing with diverse cultures and work ethics across borders and continents.

Direct consequences

Being the largest employer in the locality directly implied that Murray and Roberts had to be consistent with the idiomatic Zulu expression of “Umuntu ngumuntu ngabantu”. This means: I am because you are, you are because we are.

Good leadership in the Ubuntu philosophy is based on the engagement with communities and defines a well-led organization.

Not paying attention to ethical issues surrounding a community or the environment can have an adverse effect on your values. This would also affect your staff and the image of the company you steer.

A bitter consequence of the failure of ethics was evident in the $4.2m (64.1 million ZAR) fine to the said company. This was for its involvement in sector collusion related to construction projects for the 2010 World Cup.

Concluding remarks

Finally, a practical leader will also consider any upcoming projects with the lens of understanding the environment that surrounds them to incorporate the concept of sustainability.

These traits might sound like they need to be learned but most should be already ingrained or come naturally to you or your leaders.

If not this is not the case, you need to quickly install the right personnel with such to help steer your business enterprise or economy for that matter, to success.

*This blog post contains excerpts and is derived from a master’s research paper. It was conducted by Bonnie Moyo for the Rhodes University Business School.