As an Arsenal Football Club fan, one has the natural tendency to follow the progress of both present and past players of the revered North London title-winning institution.

The prestige of playing for the club comes along with all the bell and whistles required to make life living in the small yet expensive hub city often dubbed to be the centre of modern Europe, a breeze.

It was rather sad to read about the unfortunate fortune of a former player who had a big heart and passion for the beautiful game. He was, however, a bit aloof and care-free on the pitch. It turns out this was a character trait that perhaps extended to his financial affairs.

He was recently reported as sleeping on the couch of a friend without a penny to his name. How can that happen, you might ask?

His weekly wages were a reported 50 000 Great Britain Pounds! So how did he go from earning that figure, to being dead broke?

Such a bad turn of fortune is not uncommon for celebrities, qualified professionals, and lottery winners. This can be explained by a simple lack of ‘investor mentality’.

The right state of mind

This mindset can be instilled in us from a relatively young age if you have had the luxury of growing up with parents, teachers or a mentor who imparts this knowledge to you. It can also be learned later in life – often the hard way.

Similar to starting a business, the biggest barrier to entry into any form of investment is always the initial capital. Once you have it, coupled with the investor mentality, it’s hard to fail financially in life: just ask the current sitting American president!

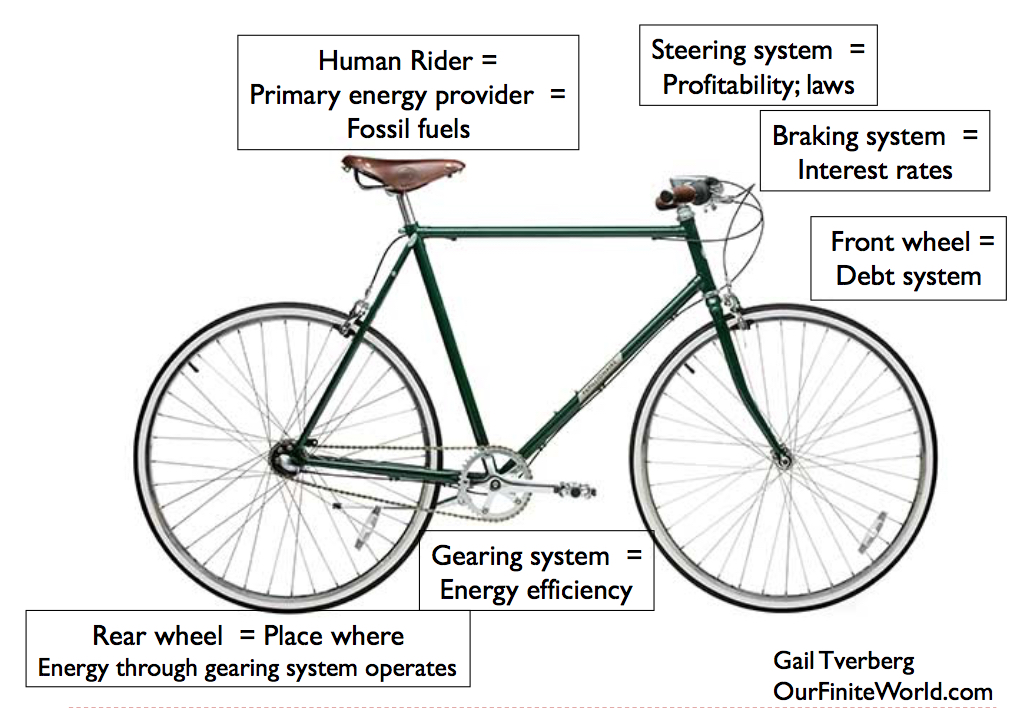

Now as obvious as this sounds, you need to put in money to make money. That is why investing, for instance, is mainly carried out on a large scale by banks – with your money!

What you do with the money when you inherit it, win it, or save up from a weekly or monthly project-based income is more important than just having it in the first place.

Wouldn’t you agree that money comes then often goes faster than you realize? Having a grasp on why it leaves so fast is what we should be paying attention to.

Let’s firstly be sensible about this – investing is always a long-term project. A desire to reap short-term gains or having such a mentality is paramount to risky gambling or betting against the odds.

“Patience is an investor’s game – if you don’t have any, don’t bother with the mechanisms that don’t lock you in for a few months to enable you to realize a return.”

Enough of the rhetorical questions and statements. Let’s briefly look at a few investment vehicles in the true fashion of Debunqed.

Savings

This is the least risky investing vehicle and tends to suit patient investors. Usually, it is for you if yo are the kind that loves to watch paint dry. 🙂

Your only risk would be using a non-government backed bank for it. The higher the amount you invest, the better the interest rate you get. So this basically benefits the already wealthy. Some savings accounts are even known to offer you 0% or fractional decimal interest rates which are calculated nominally.

So it begs the question – why would you even consider putting your money in savings? Well, using this investment strategy helps with a good credit score. That comes in handy when you apply for loans or obtaining financial backing to start your new business. So they do have some use.

Risk level: Little to none.

Property (residential or commercial)

This is the golden nest egg of investing – that is if you can raise the bond for property or inherit one.

Property is one asset class that tends to only appreciate and relatively well over the years depending on what is happening in the area/town or economy.

Getting in is the difference between having a spender or an investor’s mentality.

What do we mean by this? Well, if you can save up for a deposit to buy a brand-new luxury car, you could and should do the same for a house.

That way each “monthly rent” payment goes towards something you will eventually own. You could also buy-to-rent. The income generated from the tenant (rent) will help you pay off the bond.

Consider the appreciation value of property in your local area over the years. But like anything valuable, you must be prepared to maintain its upkeep – the costs will be more than your weekly carwash.

In the long-run when you realize the greater future value, you could even downgrade to have some extra cash to spend. You could then get that car of your dreams or travel and see the world.

Risk level: Low to moderate.

Share/Stocks

The days of stockbrokers are numbered. Trading firms and hedge fund companies are slowly being replaced by AI computers. These days, you can take full charge of a portfolio of equities, CFDs, Futures, Commodities, Options, Forex and Cryptocurrency directly from your laptop.

There are a number of online trading platforms out there so it is a good idea to go with the accredited ones.

One of the key benefits is that they all offer a free trial – which often gives you a mock .account. That’s a great way to learn about the tools and the above-mentioned markets.

There are aspects you need to pay attention to. One of them is leverage trading . It is essentially borrowing money to trade (payable with interest) – a double whammy if or when things go south for you.

Risk level: High to Excessive.

Mutual funds

As the name suggests it is derived from a pool of funds from a specific institution or industry. Mutual funds are offered by institutions as a supplement to retirement plans (pensions and annuities).

They offer you a return (often a stable monthly or quarterly pay-out) based on a fixed term that you agree on with your portfolio manager.

The offering institution would then apply your pooled monthly contributions into a diverse portfolio to spread your risk exposure.

This, however, requires the attention of a (paid) portfolio manager and is thus susceptible to the principal-agent problem.

Risk level: Low to moderate.

Venture Capitalism/Angel funds

If you have some spare cash and don’t want to bear the risk and burden of running a business yourself, you can fund other people you believe will be successful.

In this arrangement, confidence is placed by you on the owner and the offering. You can then state the terms for the release of your funds such as a quarterly return on investment or a larger stake in the business and its profits.

Rapper Nas is known for his investment in Silicon Valley start-ups as a Venture Capitalist – which gives him a share in the companies he backs with the hope of it growing exponentially to increase that shareholding’s worth.

Celebrities and sports stars usually have the capital to diversify their portfolio by investing in or starting up a new business. One such notable venture was the one where Rapper/Producer Dre’s Beats brand got bought by Apple for three billion USD.

Risk level: Moderate to high.

Rare items

Though not an easy commodity to come by because often the initial value can be quite high (unless of course, you are lucky to find an item at a junk sale or low-key auction), rare commodities can also form part of your future financial security.

Rare coins tend to take a long time to mature in value. Likewise, a painting can appreciate quickly in value if the artist’s “interesting” background comes to light in the press for good or bad reasons.

As an example, a rare Nelson Mandela coin once sold for 100 000 USD while he was still living. So, one can only imagine what the few in circulation are worth now.

Read more about rare coins here.

A rummage around old antique shops and secondhand sales can reap rewards if you know what you’re looking for.

Risk level: Low to moderate.

Bonds

These are long-term interest-bearing certificates issued primarily by governments (via monetary policy) but also by certain large public institutions.

Bonds give you a guarantee of a future value using a specially controlled interest rate. They are usually issued with fixed terms and can only be accessed after 3 to 10 years.

This locks you in, to hold the bond for the agreed period regardless of which way the interest rates are going.

Naturally the higher the rates the better for you. As a cautionary note, you will be subjected to the regulatory activities and monetary policies of the country in which you hold the bonds. Choose where you buy very wisely.

and research your product.

Accessing bond markets is also not easy and you may be subject to complex rules pertaining to the country, residence status and your credit score, and so on.

It is really for the long-term investor and can be used in the same way mutual funds tend to be applied, to supplement one’s retirement annuity package.

Risk level: Moderate to high.

All things investment

You need to remember the importance of imparting this knowledge to our youth, friends, and family so as to continue the cycle.

The simple answer being: Education. The lack of it is one of the fundamental causes of poverty.

A number of celebrities and sports stars have overlooked it’s true importance so as to follow their true passion and skill. This is not necessarily a bad thing. If you have the right people around you to help you manage your finances.

It was reported he signed documents without knowing the full content and liability of what was being presented to him. It was also said that she would even bring paperwork to the football club’s training ground for him to sign.

Let’s be honest, we don’t know the full facts but there is a lesson. This “wife” character could be anyone that you entrust with managing your finances so, be wise as to who you choose to oversee your accounts.

Make a plan

Having a grasp of your assets (if any) less your liabilities is the first place to start. Once you know what you have or don’t have, you can then set goals.

Think about what you need to do to achieve a net worth that will sustain you for the long term.

Granted we all must pay bills. We will write down that part of our income but we need to focus on what is being done with the money that is left once your overheads are met.

Educate yourself (skip a binge session on Netflix). Take a deeper dive into the investment vehicles briefly spoken about. The resources page will provide more comprehensive details about all seven vehicles discussed.

It will also guide you on where to go to find out more once you have decided and which vehicle or combo would fit your investment type and appetite for risk.

Make 2018 a sensible year finance-wise and happy investing!

If that sounds impressive you will be further astounded to know that even lower grades of the coin such as the proof 66 5 Rand Mandela cost 735 Rands ($62) in 2006. It then commanded growth of over an astonishing 900%.

If that sounds impressive you will be further astounded to know that even lower grades of the coin such as the proof 66 5 Rand Mandela cost 735 Rands ($62) in 2006. It then commanded growth of over an astonishing 900%.