You can still tap into the pool of 17-odd million Bitcoins that is now in circulation. You can even purchase them in the fiat currency equivalents.

You can still tap into the pool of 17-odd million Bitcoins that is now in circulation. You can even purchase them in the fiat currency equivalents.

But where do you get them then? After all, Cryptocurrency is this dark and mysterious transaction system used only by criminals and drug addicts.

So you acquiring them would naturally be in a shady place like the dark web – where it is used to acquire illicit things – right?

Not quite and there are publicly accessible marketplaces where one can securely purchase Bitcoins.

Find out more via A peer-to-peer Crypto marketplace

Tag: Crypto

-

A peer-to-peer Crypto marketplace

-

Top Crypto coins to look out for now

Some nice insights into the trending top Cryptocurrency coins out there with a good explanation as to why they are great coins to invest in.

A good idea to look into these ahead of a potential June ‘bull run’ via My TOP 10 Coins

Or you can own Bitcoins directly:

-

For investment gains or for purpose?

As much as institutions, risk-averse, or simply skeptical people have downplayed the new digital currency revolution. It still, a decade after coming to public light, remains resilient.

Bitcoin now gets a regular mention in daily news and stock market reports. It is being traded by several established investors and even included by fund managers as high-risk portfolio instruments.

We all by now, have heard the rhetoric of high volatility and use for criminal activity when it comes to Bitcoin and its crypto-family.

Billionaires Warren Buffet and Bill Gates also weighed into this by publicly lambasting Bitcoin. Buffet equated cryptocurrency to rat poison 🙂

Be it may, digital currency, however, does have some unbeatable benefits and functions you cannot ignore.

Financial emancipation

Bitcoin and ‘altcoin’ investing have created a new wave of financial investors.

These include retired bankers, ‘millennials’ – who instinctively jump on-board a new discovery that has creative destruction-like tendencies. You also have the plumber, bartender, or ‘average man on the street’ looking to change their lifestyles instantaneously.

Based on their phenomenal returns, many people have taken to social media (via groups, profiles, and communities) to share their success stories. But this is also a reason to for you to heed caution when you take counsel from anyone claiming to be an expert in cryptocurrency investment.

Volatility is not new to trading – and especially not with Crypto trading. It is constantly on a rollercoaster ride making it hard for even seasoned trading experts to predict movements with traditional market analysis tools.

Money transfer

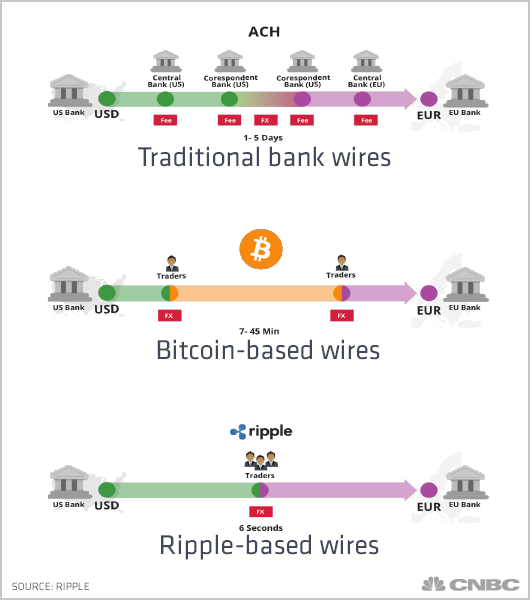

We all have undergone the painful stress of waiting for funds to clear so your rent gets paid or waiting endlessly to receive money from abroad.

With cryptocurrency, the aim is to be not only the most secure form of funds transfer – but the fastest.

Converting cryptocurrency to fiat money, however, remains a bottleneck. It still needs institutions to adopt or directly accept payments in cryptocurrency to avoid you going through another step in order to transact.

Cryptocurrencies still cut down transfer time significantly compared to traditional electronic fund transfers of fiat money.

Some well-established companies already use Cryptocurrencies like Bitcoin, and Litecoin for fund transfers, or even direct exchange for services.

Cost savings

We cannot ignore the reduced costs associated with dealing with money you have (hopefully) earned from hard work.

Even inheritances are gained because of the toils of the giver’s hard work. So, it wouldn’t be fair for a group of a few companies headed by executives to siphon it from you while claiming to ‘provide you with a service’.

We all pay for Internet use (and the security software associated), for smartphones and computers.

We, therefore, have the technology to make transactions ourselves without having to rely on others to charge us for things we can do ourselves.

The financial institutions have long preyed on your ignorance, obedience, and unquestioning trust. This, while they brazenly burn cash dabbling in equally questionable high-risk investments like derivatives and futures.

Use cases

Cryptocurrencies have nevertheless, got us thinking about making profits, the tax implications, and anything financial for that matter!

A recent development called Hodl Waves attempts to track and predict Bitcoin movements via complex usage history. It basically compares behavioural patterns of what you do when you have coins and when you choose to reinvest them.

Blockchain technology has also spurred a new path of careers and industries. More companies globally are looking to acquire lucrative Crypto-exchange licenses to operate.

These cryptocurrency exchanges require people to service clients in various areas. They will require employees as any company would.

Governments too will benefit from their operations. While there are still discrepancies in most countries about how to tax you, authorities can get a lion’s share from directly taxing exchanges.

A new wave arises

It is only a matter a time before the banking institutions and big companies get on board to benefit from the high-level encryption and speed provided by digital currency.

To conclude, the ‘wait and see’ mantra is all that we can exercise when predicting the future of digital currency.

There are, however, concerns on how secure the encryption can remain with the advent of quantum computing. This ground-breaking tech can make calculations at millions of speeds faster and thus able to crack the toughest data encryption.

Some form of regulation would be required in some form to keep Crypto prices stable.

-

Piggybacking on company success

After having several conversations which clearly highlight the fact that the business of share trading and its intricacies still create a dark cloud to many, and an unnecessary element of sophistication at that, it is only fair to (in true debunqed.com fashion) take a step back, delve in and break it down by discussing not just the way to trade – but the whole point of it. It can seem like something only smart people engage in. This is, however, not the case.

The first thing to understand is that shares (referred to in the US as stocks) entitle the holder to have part ownership in a company. So, if you own a share in, Amazon, Deutsche Bank, Coca-Cola, Manchester United or a Cryptocurrency company like Ripple – you OWN a part of the company. You are basically co-owning with other stakeholders of the company with the hopes that the people who run it will increase the monetary value of your shareholding by making the company a success.

Now your share/ownership will determine what level of control (decision-making powers) you have when it comes to the company’s operations. Naturally, owning just 10 or even 1000 shares of Amazon (which cost around a hefty $1400 each today), still does not entitle the owner to have a say in how it is run. The majority shareholder – which would probably be the company owner (chairman/founder) or its board of directors, depending on how the company is structured, will still have the overall say.

To gain a majority shareholding and therefore full control of a company, the minimum number of shares one would need would be 51% of the total issued…good luck obtaining that many!

But let’s take a further step back and unravel why shares are issued in the first place. A company has a value and within that context will always keep tags on the capitalistic market and carefully monitors its value to brace for a potential takeover or a consideration to sell.

So, to get listed on a stock exchange a company will decide how much of its equity to publically issue as shares and might even use it to raise more capital to help grow the business.

This form of equity will be backed against its total assets (and its debts) on its balance sheet. So hypothetically, a company with 100 Euros worth of assets and liabilities has 100 Euros worth of (owners) equity – which basically enables one to determine its worth at a given point in time.

The easiest way to remember this is through this basic accountant’s formula:

Total Owners Equity (OE) = Assets (A) + liabilities (L).

The shares are accounted for in the OE and are issued in denominations based on various factors to provide an indication of the relative strength (or weakness), or potential growth of the company. The (snapshot) total value of the company is thus determined by its share price plus number issued and referred to as its market capitalization. There are several other measures and tools to evaluate the general health of a company.

Rising shares, though always good will not always necessarily mean the company is great value for money as share prices can also be under- or overvalued. Shares for large companies are naturally offered in millions and via an initial public offering (IPO) from as little as one cent or more (depending on its valuation upon listing on the market) and rise to what was quoted for Amazon earlier – which along with the price of certain commodities are one of the highest per share currently available in the open market.

The open market of local bourse is where shares can be bought and sold at specific times depending on side of the world it is located – just like in a traditional marketplace.

Obtaining shares may come with an additional cost (brokerage fees, commission, interest payments in cases of leverage buying etc.) depending on the terms and conditions of the market but more specifically, on the company or broker offering access to the shares.

A good company share will also offer its holders in return an annual dividend – which is basically a share of the company’s profits over and above the share price. So, it is a good idea to include dividend-yielding shares in your trading portfolio if you can afford them.

Once you purchase your stake in the company, you will naturally, even if you don’t have a controlling say in how the company is operated, take a keen interest in the company’s activities as everything it does within its operations or outside ops for that matter will have an impact on its valuation, and therefore, the price of the share you own.

Naturally, investors follow the age-long rule of common sense and buy when the price is low. If you missed the IPO and dip in, the price is always a good time to even top-up for the long and eventual rise.

“Unless a company goes belly-up, a share-stock price that is going down is actually going up – in the long run.”

But the price as we know does not always go up and one must be prepared to weather such storms by not continuously focusing on the shares once you have done your due-diligence and purchased for the long haul. Playing blissful ignorance is the best advice you will get as one can become emotionally attached to the performance of the shares and have it affect your mood.

There are also a lot of trading tools to help prevent a total meltdown if the company folds-up due to external factors such as fraudulent scandals or government intervention – so keeping tags now and then is still required. The recent events and scandal faced by Facebook saw it lose a significant amount (billions of dollars within weeks) in it the value of its share price.

Read more about investing here.

There are also ways to “have ones’ bread buttered both ways” and this is where the concept of short-selling comes in. So, while we all would bet on a company’s stock to go up – there are groups of investors who bet the other way with the hopes that the price will rather drop.

This seemingly dubious form of trading is perfectly legit and comes, naturally, with a higher level of risk – that is if the price increases in favour of all ‘normal’ long-term investors – the short starts to lose money and will even have to fork out more for the amount borrowed to make the short-sell in the first place – not for the inexperienced and ill-informed!

So, you “buy” or rather borrow (with leverage) the future value of the share/stock price usually at its apparent peak (or bubble bursting price level) and hope that it will drop for you to profit from the bet by as much as it continues to drop. Earlier in the year, one such investor dubbed “50 Cent” bagged 200-million-dollars in a major shorting maneuver.

Shorting a stock is a complex, risky but highly lucrative method of balancing out a portfolio. A seasoned trader will, therefore, have several positions including some “buy” and “sell” positions on their shares for long and short terms with the various mechanisms set in place to execute their trades based on those positions.

One wouldn’t just short a stock if one didn’t know something about what was to come or what factors were to lead to a sharp and large drop in the share price. But getting this right is often an exercise that straddles a fine line between being well-informed and intuitive and blatant insider trading.

So, in summary, shareholding happens naturally when you acquire a stake in a business through ownership of its intellectual capital, founding rights, or status as a funder or initial investor to help start the business.

So why do companies issue out shares to the public again you might still ask… think of share listing as a way for a company to hold itself publicly accountable and thus is the ultimate branding weaponry in its arsenal and quest to exponentially increase its profits.

-

Piggybacking on company shares

It is clear that the business of share trading and its intricacies still create a dark cloud for many of you. This is, however, a rather unnecessary element of sophistication.

It is only fair to, therefore, delve in and break it down by discussing not just the way to trade, but the whole point of it.

While trading may seem like something only smart people engage in, this is, however, not the case.

What are shares?

The first thing to understand is that shares (referred to as stocks) entitle the holder to have part ownership in a company.

So, if you own a share in, Amazon, Manchester United, or a Cryptocurrency company like Ripple – you literally OWN a part of that company.

You are basically co-owning with other stakeholders of the company. This with the hopes that the people who run it will increase the monetary value of your shareholding by making the company a success.

Now your share will determine what level of control (decision-making) you have when it comes to the company’s operations.

Naturally, owning just one, ten, or even 1000 shares of Amazon (a hefty $1400 each today), still does not entitle you to have a say in how it is run.

As the majority shareholder, you would probably be the company owner (chairman/founder) or one of its board of directors. To gain such a majority shareholding and full control of a company, the minimum number of shares you would need would be 51% of all shares issued. Good luck obtaining that many!

The rationale for issuing shares

But let’s take a further step back and unravel why shares are issued in the first place. Your company (hopefully) has value because of its ability to generate revenue. This makes it a constant target for investors in a capitalistic market. Wealthy individuals carefully monitor its value to brace for a potential takeover or for just a piece of the pie.

To get listed on a stock exchange your company will decide how much of its equity to publicly issue as shares. You can even issue shares to raise more capital to help grow your business.

This form of equity will be backed against your total assets (and its debts) on the balance sheet. So hypothetically, a company with 100 Euros worth of assets and liabilities has 100 Euros worth of (owners) equity.

This basically enables you to determine its net worth at a given point in time.

The easiest way to remember this is through this basic accountant’s formula:

Total Owner’s Equity (OE) = Assets (A) + liabilities (L).

The shares are accounted for in the OE and are issued in denominations based on various factors. This helps to provide you with an indication of the relative strength (or weakness), or potential growth rate of the company.

What do they tell us?

The (snapshot) total value of the company is thus determined by its share price multiplied by total number issued. This is referred to as its market capitalization. There are several other measures and tools to evaluate the general health of a company.

Rising share prices, though always good, does not always necessarily mean that the company is great value for money. This is because share prices can also be undervalued or overvalued.

Shares for large companies are naturally offered in millions and via an initial public offering (IPO) from as little as one cent (penny stock), or much more (depending on its valuation). Thereon, it can rise astronomically to what was quoted for Amazon earlier.

Where to get them

The open market or local bourse is where you can buy and sell shares at specific times depending on side of the world it is located.

Obtaining shares come with additional costs (brokerage fees, commission, interest payments in cases of leverage buying, etc.). Depending on the terms and conditions in the overall market (regulations), but more specifically, on the company or broker offering you access to shares.

A good company share will also give you a return on an annual dividend. This is basically a share of the company’s profits over and above its share price.

It is a good idea to include high dividend-yielding shares like Coca-Cola, in your trading portfolio – if you can afford them.

Influencers

Once you purchase your stake in the company, you will naturally, even if you don’t have a controlling say in how the company is operated, take a keen interest in the company’s activities.

Everything it does whether internal operations or outside for that matter, will have an impact on its valuation.

Naturally, investors follow the age-long rule of common sense: buy when the price is low. If you missed the IPO and the price dips, you can always get in at a good (low) price. The stock market runs like a rollercoaster – you just need the right time to hop on!

“Unless a company goes belly-up, a share-stock price that is going down is actually going up – in the long run.”

Obviously, the price (trend) is not always upward and one must be prepared to weather such storms. You shouldn’t have to be continuously focusing on the price after thorough due diligence on your chosen company.

Read more about Due Diligence here

Choosing a good stock and leaving it to work is the best advice you will get. This is because you can become emotionally attached to the performance of the shares and that can affect your mood.

There are also a lot of trading tools to help prevent a total meltdown if the company folds-up. This can be due to external factors like fraudulent scandals or government intervention. Keep tags now and then – this is important.

The recent events and scandal faced by Facebook saw it lose a significant amount (billions of dollars) in it the value of its share price.

Read more about investing here.

Short-selling of shares/stocks

There are also ways to “have your bread buttered both ways” in investing. This is where the concept of short-selling comes in.

So, while we all inclined to bet on a company’s stock to go up – there are groups of investors who bet the other way. They have the hopes (based on indicators) that the price will rather drop.

This seemingly dubious form of trading is perfectly legit but comes, naturally, with an even higher level of risk. If the price increases in favour of all ‘normal’ long-term investors – the short position starts losing money. You may even have to fork out more to cover the amount borrowed to make the short-sell in the first place.

Short-selling is, therefore, if you are inexperienced and ill-informed!

So, you “buy” or rather borrow (leverage) the future value of the share/stock price usually at its apparent peak and hope that it will drop. You will continue to profit from the bet by as much as the share price continues to drop.

Earlier in the year, one such investor dubbed “50 Cent” bagged 200-million-dollars in a major shorting stint.

Shorting a stock is a complex, risky but highly lucrative method of balancing out a portfolio. A seasoned trader will, therefore, have several positions including some “buy” and “sell” positions on their chosen shares.

You should have various mechanisms (take profits and stop losses) set in place to execute their trades based on those positions.

Naturally, you wouldn’t just short a stock if you didn’t know something about what factors were to lead to a sharp/large drop in the share price.

But getting this right is often an exercise that straddles a fine line between being well-informed and intuitive and blatant insider trading.

The bigger picture

So, in summary, shareholding generally occurs when you acquire a stake in a business. You can own intellectual capital, founding rights, or be s a funder/seed investor to help start the business.

So why do companies issue out shares to the public again you might still ask?

Think of share listing as a way for your company to hold itself publicly accountable. is the ultimate branding weaponry in its arsenal and quest to exponentially increase its profits.

-

Conjecture buying

Before throwing our coins out of the pot or making second guesses about a big crash one must understand how the price of altcoins works.

The price of some altcoins on the trading market has a lot less to do with its intrinsic value. It is actually what individuals, and most traders (who seek only profit), believe it to be worth.

So, what is the reason behind the recent downward price spiral? Not much conspiracy to “ruin the cryptocurrency” other than an expected price correction coupled with some external factors.

Punters including ‘corner shop’ setups inflated the price with rampant price speculation. Speculation based on nothing more than historic (and a short history) rise of the price of the coin from only a few cents to almost $65 000 each (adjusted to 2021 all-time-high price).

The idea of creating an invention that performs a certain function quite soundly and then limiting its supply displays the financial clout of its creator/s.

That way, the natural laws of supply and demand would drive up the price of Bitcoin, as it became rarer though needed. It is already becoming harder to attain (through mining) and as it encroaches its supposed 21-million-unit limit.“The fact that people keep talking today that bitcoin is below 10,000, it’s a disaster, or bitcoin is above 10,000 and that’s crazy. I think the fact that bitcoin is still alive, and attracting so much attention, is the fact that we’re talking about bitcoin in Davos with a Nobel Prize winner, a central bank governor, and a seasoned investor. I think that’s a powerful tool.” – Jennifer Zhu Scott (Radian Partners principal) – 2018.

External influencers of price

But there are external factors that come into play that affected its speculative price. Factors such as the rise of other altcoins after the split in its technology.

Bear in mind that the blockchain code is open to anyone smart enough to develop and run a product on it.

So, there is also some kind of a substitution effect as newer altcoins become more specific in purpose and faster in executing transactions.

This results in people switching from Bitcoin to the likes of Ethereum-run newcomers like DigixDAO.

These new coins are doing well (if the rising price is an indicator) and climbing while others lose both intrinsic a speculative value.

External factors including market sentiments do in fact play a huge role in determining the demand for the product or service. In the case of Bitcoin, the closing down of some Exchanges in Asia as well as talks of heavier regulation. Such was mentioned at the World Economic Forum in Davos 2018.

Global leaders pledging to take tougher measures to regulate cryptocurrencies raises cause for concern for people with significant amounts invested.

So, the usage by criminals, for instance, has created a much-expected reluctance by governments and financial institutions to accept its legitimacy.

There is also a constant and sometimes subliminal shift in thinking, as trading involves a lot of psychological and emotional play on buying behavior.Buyer behaviour

One such example is the impulse people have when purchasing items that are supposedly on ‘special’ or at a low price.

A 75% discount on a pair of shoes only tells you that the seller has marked it up so high that they could still make a profit when they knock it down by that much!

You only notices the price (before and after) the discount. This is without realising that it cost the buyer a fraction of both to produce, package it and get it shipped to the store.The true value of ‘the shoe’ lies in the materials (quality) used to produce it for it to last long or give it its level of comfort (its true purpose). That and its appearance of course.

The “brand name and image” in this case can thus be compared to the speculative aspect of a commodity.

So, a pair of pumps would sell (at a higher than normal price) if the likes of Beyoncé or Gal Gadot are seen wearing them.

The same goes for sportspeople and the whole multi-million dollar/euro endorsement deals they carry. Their endorsement of a product thus ‘legitimizes’ it.

When global leaders, banks, and financial institutions raise concerns about cryptocurrency – it does the very opposite. This sets off-market panic and the selling-off we are currently observing.The future of Crypto

So, what will happen from here on? Provided it is not outright outlawed. This is, however, proving to be difficult as even the South Korean government have now softened their tough stance on the Crypto Exchanges.

This is after they discovered what a tax ‘gold mine’ Crypto exchanges can be. This is then when the speculative buying will begin again.

Investors who couldn’t purchase Bitcoins at levels above $20 000 will now be seeking an opportunity to enter the market.

Especially if it dips below the $30000 mark (it is currently $34 000). This with the hope to make some decent profit even if it just pushes back to $50 000.

Some will hold on and speculate on a return to previous highs – and so the bullish and bearish cycle continues.

Authorities including the delegates at the Davos talks were in agreement, however, that they will want it at affordable prices. At a level that stays relatively stable, they may even start to consider it as ‘global legal tender’.

But that will be a long time, especially if traders continue to buy it speculatively to make profits.

Those awaiting a total crash of Bitcoin, altcoins, or the blockchain, however, would have to hold their breaths.

The technology is indeed a game-changer and has already been widely adopted. It will only change form to be partially or fully regulated.The core functions of blockchain-based currency will remain its main contribution to the evolution of banking and ‘money’ transfers.

-

Forex on steroids!

With all the negative and positive commotion surrounding the Crypto market – it still begs the question, for those still curious. What does it take to engage in the trading of Cryptocurrency?

And by trading, we are not referring to the price speculation in a portfolio as one would with the price of a company’s shares or even CFDs.

We are rather referring to trading it as a commodity against other ‘Cryptos’ in a properly regulated online market setting. Similar to how a Foreign Exchange (Forex) market operates.

As with trading traditional fiat currencies, the price is purely determined by good old supply and demand for the currency and monitored by the availability versus volume traded.

It is therefore just a medium between traders where they can set limit orders to buy/sell Bitcoins for a certain price.

So, in the true approach of Debunqed, we will decipher crypto-exchange trading by looking at what you need to do to get into it, and what you stand to gain.

Here are the quick steps:

The first step would be to open a secure Crypto wallet to physically purchase (own) some altcoins. Bitcoin, Ethereum, and Litecoin are the main coins offered by Crypto wallet providers.

They hold the most value and can thus be broken down into smaller denominations (Altcoins). The same way the dollar is used as the main exchange for other fiat currencies. This example helps to put things into perspective.

Make sure you do your research into which wallet you will use. Obviously, if you are mining a certain Cryptocurrency you would naturally purchase them directly from that software provider of the Altcoin.

Using Ripple mining as an example, the platform is supplied by RippleNet and naturally, it follows that the Ripple company mines all the volume and controls its supply.

Getting the digital currency into a wallet can be a quick exercise.It can take as quickly as between 5 – 20 minutes via a peer-to-peer Bitcoin marketplace connecting buyers with sellers like at Paxful.

Make sure you deal with reputable sellers. This wallet provider rates suppliers based on how reliable they are so only deal with sellers of the highest ratings.

The actual purchase (mostly conducted via online chat) can be made via a Credit/Debit Card, online banking or convenient money transfer facilities like (Europe-based) N26 Bank, Skrill or PayPal.You can even purchase and send gift cards from Amazon for instance, to the seller (to the value of the currency being purchased) for the seller to release the Altcoins.

Security and storage

The actual coins are stored as an alpha-numeric key code – with the currency value in the wallet once acquired.

This after the wallet-broker takes a small fee for the transaction. This code/key needs to be kept secure – backed up online and offline (highly recommended). This is possible on special flash-drive (Crypto wallet) like the Trezor or a Ledger Nano. The device would hold the deposit key if you were transferring it to another wallet or to an exchange to trade.

Time to go shopping!

Finding a good exchange

The next step would be then to source a robust and user-friendly platform to trade your newly acquired currency on.

The best cryptocurrency exchanges would allow you to swap fiat currency such as dollar/euro for the digital currency directly. Naturally, you can trade one digital currency for another as well.

There are quite a few to choose from so it is good to read the reviews. You should then select one based on the number of deposit/withdrawal methods, the fee structure level, number of countries served, availability of security tools and features.

The last aspect is a huge determining factor: exchanges can be prone to hacking, or loss from outages. Lastly, their margins and exchange trading functions are good to observe too.

For serious and equally secure trading, you will likely need to use an exchange like Binance that requires the user to verify their ID before being opening an account. Make sure you have all your documents ready and up to date!Trading

When it comes to the actual trading, let’s take a scenario where two people want to sell an altcoin but not for the market price. One sets a limit order for lower and the other for a slightly higher price. So, the best price to purchase Bitcoins, in this case, would be the median of the two prices.

If the buyer wants to purchase more than one altcoin, they will continually take the lowest price available. By doing this, the “price” of the altcoin will increase as the lower-price sell orders are no longer available.

You will then, as with Forex, purchase pairs of where you think your digital currency will be stronger against another e.g. BTC (Bitcoin) vs XRP (Ripple).

This combo would look like this on the exchange: BTC/ XRP – 0.00011960. What this means is that one Ripple coin is worth that much Bitcoin for instance.The little details

This type of trading, like commodities or forex, requires constant attention and the monitoring of prices. But there are tools that can also help you set prices and have the trades auto-execute.

So, a platform which provides such tools conveniently allows you the time to do other important things. Like paying attention to your spouse, formal job or family and friends. That would be ideal.

If you have the cash, time, expertise and financial clout, it is even possible to run your own Crypto Exchange!This is another benefit of a decentralized currency system that will allow you to earn some cash by charging for the usage of your robust platform.

Well, this may be until the fiscal authorities’ crackdown on all of the platforms with restrictive legislation.Finally, like many platforms that provide opportunities to purchase something, the software must be stable and be cost-effective to use.

ADVERT

-

An investor state of mind

As an Arsenal Football Club fan, one has the natural tendency to follow the progress of both present and past players of the revered North London title-winning institution.

The prestige of playing for the club comes along with all the bell and whistles required to make life living in the small yet expensive hub city often dubbed to be the centre of modern Europe, a breeze.

It was rather sad to read about the unfortunate fortune of a former player who had a big heart and passion for the beautiful game. He was, however, a bit aloof and care-free on the pitch. It turns out this was a character trait that perhaps extended to his financial affairs.

He was recently reported as sleeping on the couch of a friend without a penny to his name. How can that happen, you might ask?

His weekly wages were a reported 50 000 Great Britain Pounds! So how did he go from earning that figure, to being dead broke?

Such a bad turn of fortune is not uncommon for celebrities, qualified professionals, and lottery winners. This can be explained by a simple lack of ‘investor mentality’.

The right state of mind

This mindset can be instilled in us from a relatively young age if you have had the luxury of growing up with parents, teachers or a mentor who imparts this knowledge to you. It can also be learned later in life – often the hard way.

Similar to starting a business, the biggest barrier to entry into any form of investment is always the initial capital. Once you have it, coupled with the investor mentality, it’s hard to fail financially in life: just ask the current sitting American president!

Now as obvious as this sounds, you need to put in money to make money. That is why investing, for instance, is mainly carried out on a large scale by banks – with your money!

What you do with the money when you inherit it, win it, or save up from a weekly or monthly project-based income is more important than just having it in the first place.

Wouldn’t you agree that money comes then often goes faster than you realize? Having a grasp on why it leaves so fast is what we should be paying attention to.

Let’s firstly be sensible about this – investing is always a long-term project. A desire to reap short-term gains or having such a mentality is paramount to risky gambling or betting against the odds.

“Patience is an investor’s game – if you don’t have any, don’t bother with the mechanisms that don’t lock you in for a few months to enable you to realize a return.”

Enough of the rhetorical questions and statements. Let’s briefly look at a few investment vehicles in the true fashion of Debunqed.

Savings

This is the least risky investing vehicle and tends to suit patient investors. Usually, it is for you if yo are the kind that loves to watch paint dry. 🙂

Your only risk would be using a non-government backed bank for it. The higher the amount you invest, the better the interest rate you get. So this basically benefits the already wealthy. Some savings accounts are even known to offer you 0% or fractional decimal interest rates which are calculated nominally.

So it begs the question – why would you even consider putting your money in savings? Well, using this investment strategy helps with a good credit score. That comes in handy when you apply for loans or obtaining financial backing to start your new business. So they do have some use.

Risk level: Little to none.Property (residential or commercial)

This is the golden nest egg of investing – that is if you can raise the bond for property or inherit one.

Property is one asset class that tends to only appreciate and relatively well over the years depending on what is happening in the area/town or economy.

Getting in is the difference between having a spender or an investor’s mentality.What do we mean by this? Well, if you can save up for a deposit to buy a brand-new luxury car, you could and should do the same for a house.

That way each “monthly rent” payment goes towards something you will eventually own. You could also buy-to-rent. The income generated from the tenant (rent) will help you pay off the bond.

Consider the appreciation value of property in your local area over the years. But like anything valuable, you must be prepared to maintain its upkeep – the costs will be more than your weekly carwash.

In the long-run when you realize the greater future value, you could even downgrade to have some extra cash to spend. You could then get that car of your dreams or travel and see the world.

Risk level: Low to moderate.Share/Stocks

The days of stockbrokers are numbered. Trading firms and hedge fund companies are slowly being replaced by AI computers. These days, you can take full charge of a portfolio of equities, CFDs, Futures, Commodities, Options, Forex and Cryptocurrency directly from your laptop.

There are a number of online trading platforms out there so it is a good idea to go with the accredited ones.

One of the key benefits is that they all offer a free trial – which often gives you a mock .account. That’s a great way to learn about the tools and the above-mentioned markets.

There are aspects you need to pay attention to. One of them is leverage trading . It is essentially borrowing money to trade (payable with interest) – a double whammy if or when things go south for you.

Risk level: High to Excessive.Mutual funds

As the name suggests it is derived from a pool of funds from a specific institution or industry. Mutual funds are offered by institutions as a supplement to retirement plans (pensions and annuities).

They offer you a return (often a stable monthly or quarterly pay-out) based on a fixed term that you agree on with your portfolio manager.

The offering institution would then apply your pooled monthly contributions into a diverse portfolio to spread your risk exposure.

This, however, requires the attention of a (paid) portfolio manager and is thus susceptible to the principal-agent problem.

Risk level: Low to moderate.Venture Capitalism/Angel funds

If you have some spare cash and don’t want to bear the risk and burden of running a business yourself, you can fund other people you believe will be successful.

In this arrangement, confidence is placed by you on the owner and the offering. You can then state the terms for the release of your funds such as a quarterly return on investment or a larger stake in the business and its profits.

Rapper Nas is known for his investment in Silicon Valley start-ups as a Venture Capitalist – which gives him a share in the companies he backs with the hope of it growing exponentially to increase that shareholding’s worth.

Celebrities and sports stars usually have the capital to diversify their portfolio by investing in or starting up a new business. One such notable venture was the one where Rapper/Producer Dre’s Beats brand got bought by Apple for three billion USD.

Risk level: Moderate to high.Rare items

Though not an easy commodity to come by because often the initial value can be quite high (unless of course, you are lucky to find an item at a junk sale or low-key auction), rare commodities can also form part of your future financial security.

Rare coins tend to take a long time to mature in value. Likewise, a painting can appreciate quickly in value if the artist’s “interesting” background comes to light in the press for good or bad reasons.As an example, a rare Nelson Mandela coin once sold for 100 000 USD while he was still living. So, one can only imagine what the few in circulation are worth now.

Read more about rare coins here.

A rummage around old antique shops and secondhand sales can reap rewards if you know what you’re looking for.

Risk level: Low to moderate.Bonds

These are long-term interest-bearing certificates issued primarily by governments (via monetary policy) but also by certain large public institutions.

Bonds give you a guarantee of a future value using a specially controlled interest rate. They are usually issued with fixed terms and can only be accessed after 3 to 10 years.

This locks you in, to hold the bond for the agreed period regardless of which way the interest rates are going.

Naturally the higher the rates the better for you. As a cautionary note, you will be subjected to the regulatory activities and monetary policies of the country in which you hold the bonds. Choose where you buy very wisely.

and research your product.Accessing bond markets is also not easy and you may be subject to complex rules pertaining to the country, residence status and your credit score, and so on.

It is really for the long-term investor and can be used in the same way mutual funds tend to be applied, to supplement one’s retirement annuity package.

Risk level: Moderate to high.All things investment

You need to remember the importance of imparting this knowledge to our youth, friends, and family so as to continue the cycle.

The simple answer being: Education. The lack of it is one of the fundamental causes of poverty.

A number of celebrities and sports stars have overlooked it’s true importance so as to follow their true passion and skill. This is not necessarily a bad thing. If you have the right people around you to help you manage your finances.

It was reported he signed documents without knowing the full content and liability of what was being presented to him. It was also said that she would even bring paperwork to the football club’s training ground for him to sign.Let’s be honest, we don’t know the full facts but there is a lesson. This “wife” character could be anyone that you entrust with managing your finances so, be wise as to who you choose to oversee your accounts.

Make a plan

Having a grasp of your assets (if any) less your liabilities is the first place to start. Once you know what you have or don’t have, you can then set goals.

Think about what you need to do to achieve a net worth that will sustain you for the long term.Granted we all must pay bills. We will write down that part of our income but we need to focus on what is being done with the money that is left once your overheads are met.

Educate yourself (skip a binge session on Netflix). Take a deeper dive into the investment vehicles briefly spoken about. The resources page will provide more comprehensive details about all seven vehicles discussed.It will also guide you on where to go to find out more once you have decided and which vehicle or combo would fit your investment type and appetite for risk.

Make 2018 a sensible year finance-wise and happy investing!