As much as institutions, risk-averse, or simply skeptical people have downplayed the new digital currency revolution. It still, a decade after coming to public light, remains resilient.

Bitcoin now gets a regular mention in daily news and stock market reports. It is being traded by several established investors and even included by fund managers as high-risk portfolio instruments.

We all by now, have heard the rhetoric of high volatility and use for criminal activity when it comes to Bitcoin and its crypto-family.

Billionaires Warren Buffet and Bill Gates also weighed into this by publicly lambasting Bitcoin. Buffet equated cryptocurrency to rat poison 🙂

Be it may, digital currency, however, does have some unbeatable benefits and functions you cannot ignore.

Financial emancipation

Bitcoin and ‘altcoin’ investing have created a new wave of financial investors.

These include retired bankers, ‘millennials’ – who instinctively jump on-board a new discovery that has creative destruction-like tendencies. You also have the plumber, bartender, or ‘average man on the street’ looking to change their lifestyles instantaneously.

Based on their phenomenal returns, many people have taken to social media (via groups, profiles, and communities) to share their success stories. But this is also a reason to for you to heed caution when you take counsel from anyone claiming to be an expert in cryptocurrency investment.

Volatility is not new to trading – and especially not with Crypto trading. It is constantly on a rollercoaster ride making it hard for even seasoned trading experts to predict movements with traditional market analysis tools.

Money transfer

We all have undergone the painful stress of waiting for funds to clear so your rent gets paid or waiting endlessly to receive money from abroad.

With cryptocurrency, the aim is to be not only the most secure form of funds transfer – but the fastest.

Converting cryptocurrency to fiat money, however, remains a bottleneck. It still needs institutions to adopt or directly accept payments in cryptocurrency to avoid you going through another step in order to transact.

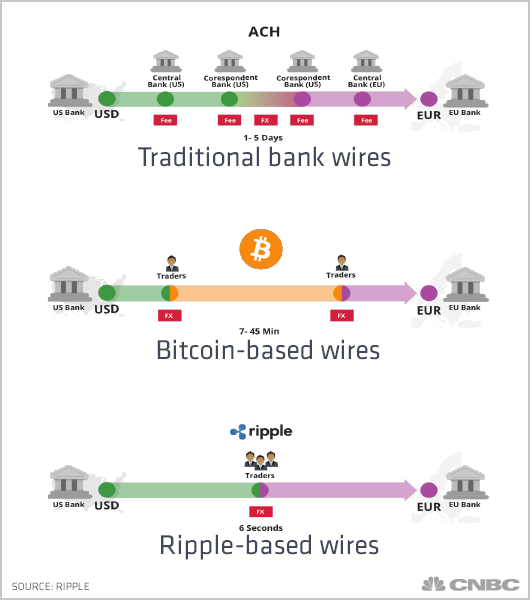

Cryptocurrencies still cut down transfer time significantly compared to traditional electronic fund transfers of fiat money.

Some well-established companies already use Cryptocurrencies like Bitcoin, and Litecoin for fund transfers, or even direct exchange for services.

Cost savings

We cannot ignore the reduced costs associated with dealing with money you have (hopefully) earned from hard work.

Even inheritances are gained because of the toils of the giver’s hard work. So, it wouldn’t be fair for a group of a few companies headed by executives to siphon it from you while claiming to ‘provide you with a service’.

We all pay for Internet use (and the security software associated), for smartphones and computers.

We, therefore, have the technology to make transactions ourselves without having to rely on others to charge us for things we can do ourselves.

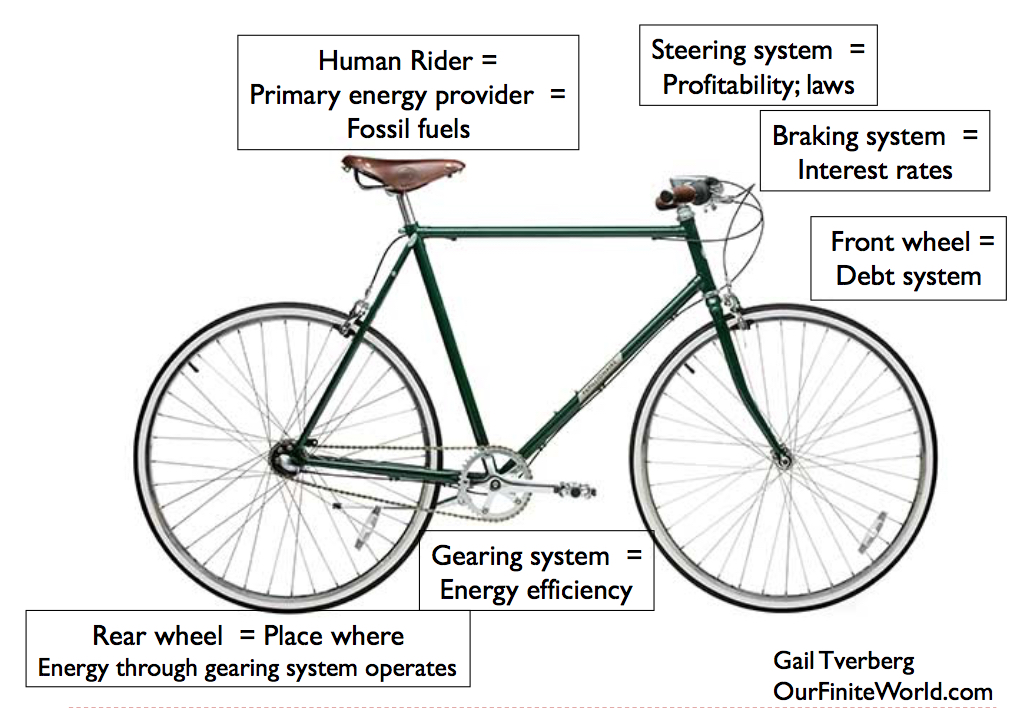

The financial institutions have long preyed on your ignorance, obedience, and unquestioning trust. This, while they brazenly burn cash dabbling in equally questionable high-risk investments like derivatives and futures.

Use cases

Cryptocurrencies have nevertheless, got us thinking about making profits, the tax implications, and anything financial for that matter!

A recent development called Hodl Waves attempts to track and predict Bitcoin movements via complex usage history. It basically compares behavioural patterns of what you do when you have coins and when you choose to reinvest them.

Blockchain technology has also spurred a new path of careers and industries. More companies globally are looking to acquire lucrative Crypto-exchange licenses to operate.

These cryptocurrency exchanges require people to service clients in various areas. They will require employees as any company would.

Governments too will benefit from their operations. While there are still discrepancies in most countries about how to tax you, authorities can get a lion’s share from directly taxing exchanges.

A new wave arises

It is only a matter a time before the banking institutions and big companies get on board to benefit from the high-level encryption and speed provided by digital currency.

To conclude, the ‘wait and see’ mantra is all that we can exercise when predicting the future of digital currency.

There are, however, concerns on how secure the encryption can remain with the advent of quantum computing. This ground-breaking tech can make calculations at millions of speeds faster and thus able to crack the toughest data encryption.

If that sounds impressive you will be further astounded to know that even lower grades of the coin such as the proof 66 5 Rand Mandela cost 735 Rands ($62) in 2006. It then commanded growth of over an astonishing 900%.

If that sounds impressive you will be further astounded to know that even lower grades of the coin such as the proof 66 5 Rand Mandela cost 735 Rands ($62) in 2006. It then commanded growth of over an astonishing 900%.