There is a lot of banter, which is backed up by well-research papers on how Automation and Robotics (powered by AI) will replace manufacturing jobs.

Blue-collar jobs are not the only ones however, that face imminent and progressive extinction.

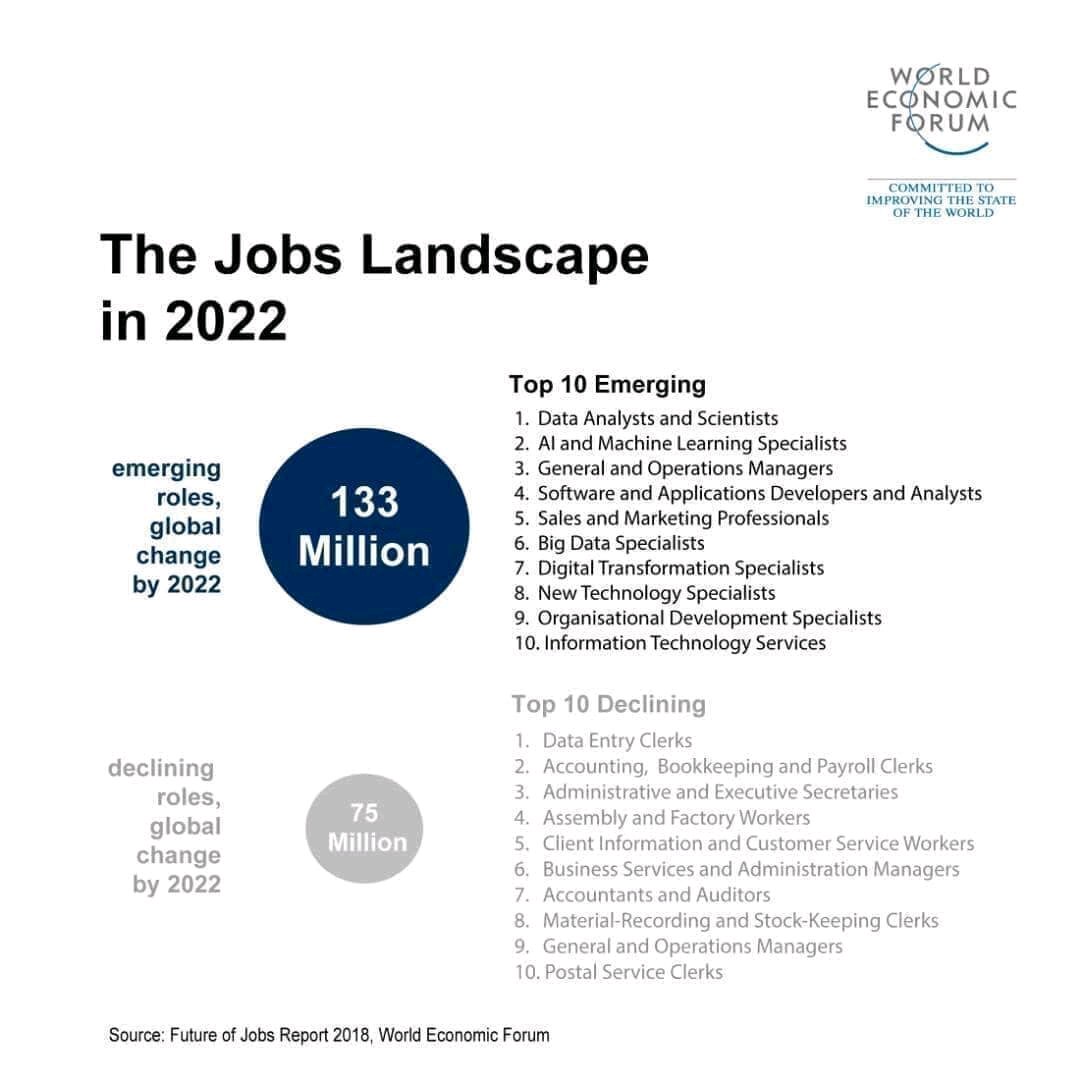

A recent survey report conducted by the World Economic Forum predicts futuristic trends affecting certain jobs in the modern workplace.

Robert Solow predicted decades ago, in his Solow-Swan model, a massive driving force of global growth: technology.

And the evidence is prevalent with the likes of Apple, Google, and Amazon championing stock markets with Billion-dollar market capitalizations. They also create an abundance of jobs globally.

Disruptive technological advances such as AI (Artificial Intelligence); the ubiquitous high-speed mobile Internet (5G); widespread adoption of big data analytics; cloud technology; and the recent Blockchain technology will be the drivers of this job evolution.

Based on the report, by 2022, this job evolution will be firmly in place as it has already.

In a matter of just 4 years, we could have a situation where jobs such as postal service clerks, data entry clerks, and bean-counters (accountants and auditors) would be made redundant.

Impact on services

Software like Microsoft’s Dynamics 365, aims to remove ‘silos’ within customer relationship management (CRM) and enterprise resource planning (ERP) processes.

The latter takes over (fully automates) back-office operations such as stock-taking and supply chain management.

Such tasks will be performed via software, reducing the need for more human supervision. Consequently, the focus would be more on managerial roles.

In the sales and customer service realm, technologies like Microsoft’s AI will provide automated insights to guide employees on improving customer experiences.

Furthermore, it may lower support costs by using virtual agents or Chatbots to eliminate in-house AI experts and those writing code. This will result in more redundancies!

On a positive note, newer and more exciting jobs such as data analysts, machine learning and AI specialists, digital transformation experts and in general information system services will be on the rise – up to 135 million globally, according to the Report.

The fields to benefit directly from new technologies would be information technology; information security; innovation; customer services and risk management (financial services).

Impact on finance

Another group of professionals whose nature of work will be affected due to the advent of ‘disruptive technology‘ is financial middlemen. Likewise, smaller banks and money transfer institutions.

Decentralized systems were primarily put in place to eradicate exorbitant fees associated with transferring money across borders.

Cutting them out completely undoubtedly renders them redundant. It is therefore pertinent for them to innovate their products in order to open up sufficient job position.

Read more about the effect of Cryptocurrencies on the banking sector here

Recently, Malta’s finance minister whilst in a private interview during a Blockchain Conference, echoed this. He said that the advent of cryptocurrency has changed financial middlemen into traditional “photo developers”.

“I can see this, just like in photography when you could tell that […] those who process the photos will lose their jobs; a lot of financial intermediaries will be facing the chop in the not too distant future,” says Edward Scicluna.

The good news for governments will be that the trend shows that the jobs created will surpass those lost.